Integrated Account

- Current Account

- Savings Account

- Fixed Deposit Account

Through the Integrated Account, you can manage your HKD, RMB and foreign currencies statement savings account1, fixed deposit account and current account under one account. Once the Integrated Account is opened, funds from different accounts can be allocated easily. With the 24-hour e-Banking service, you may enjoy banking services anytime anywhere; experiencing the efficient account management.

What account type included

- Manage your payment and transfer at ease by paper cheque or e-cheque for Hong Kong Dollar, US Dollar and Renminbi

- Provide you with Easy Transfer Service in Hong Kong Dollar Current Account to protect against bounced cheques

- Cheque books are available for free

- Have a minimum initial deposit

- Manage Hong Kong Dollars, US Dollars, Renminbi and 12 other foreign currencies in your Integrated Account

- Offer you daily accrued interest posted semi-annually

- Fixed deposit account allows you to enjoy higher interest rate by depositing fund for a set period of time.

- The tenors of the deposits may vary from 7 days to 12 months subject to currency.

- Preferential rates will be provided for deposits of HK$500,000 or above or equivalent.

- You can preset the account for fund transfer upon its maturity or select to roll over automatically through internet, phone and mobile banking.

- Minimum deposit amount is required which is HK$50,000 for Hong Kong Dollar.

Features

Easy Transfer Service

Auto Fund Transfer for Cheque Issuance

Cheque Return & Direct Debit Protection

Immediate Effective

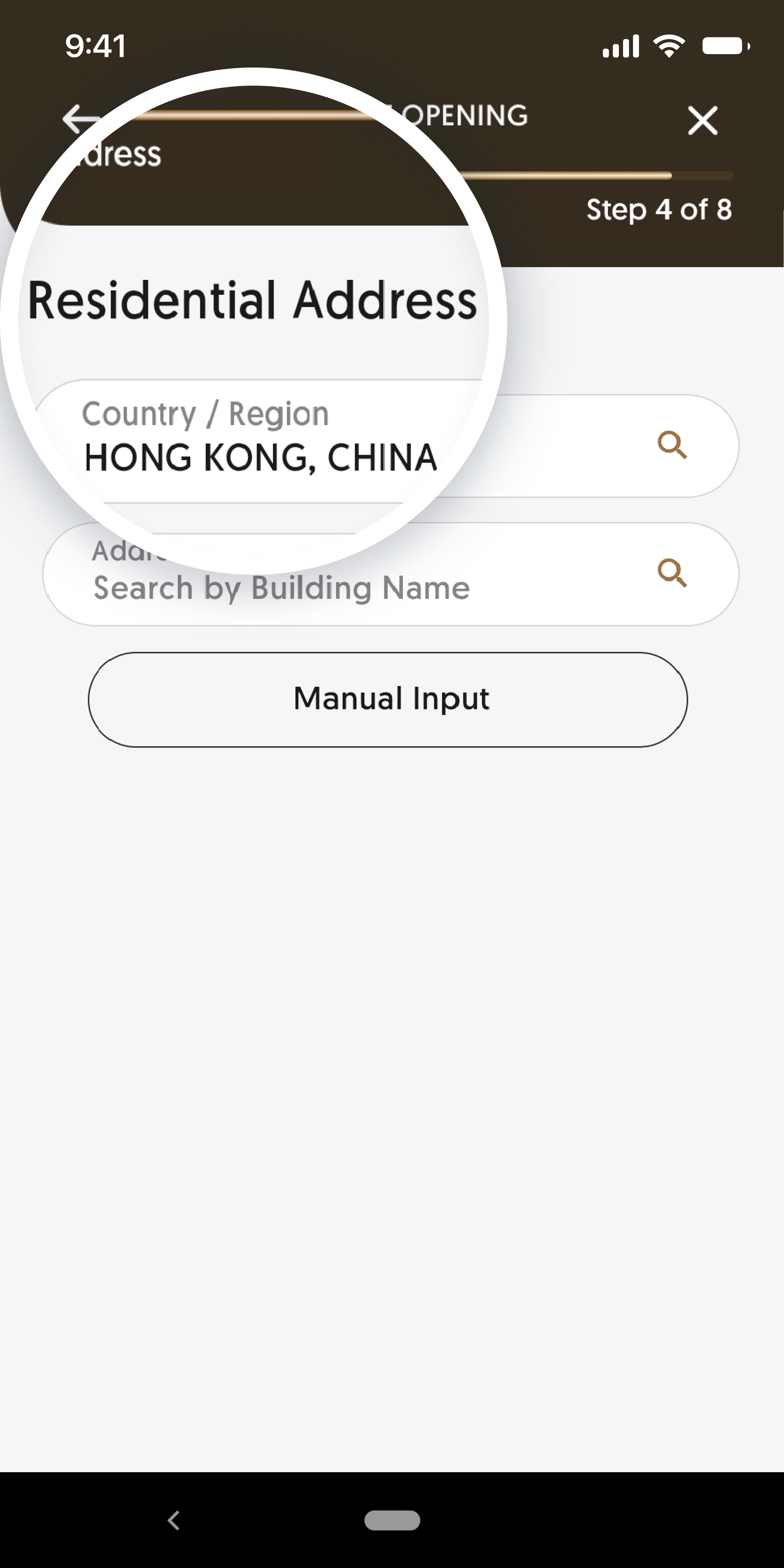

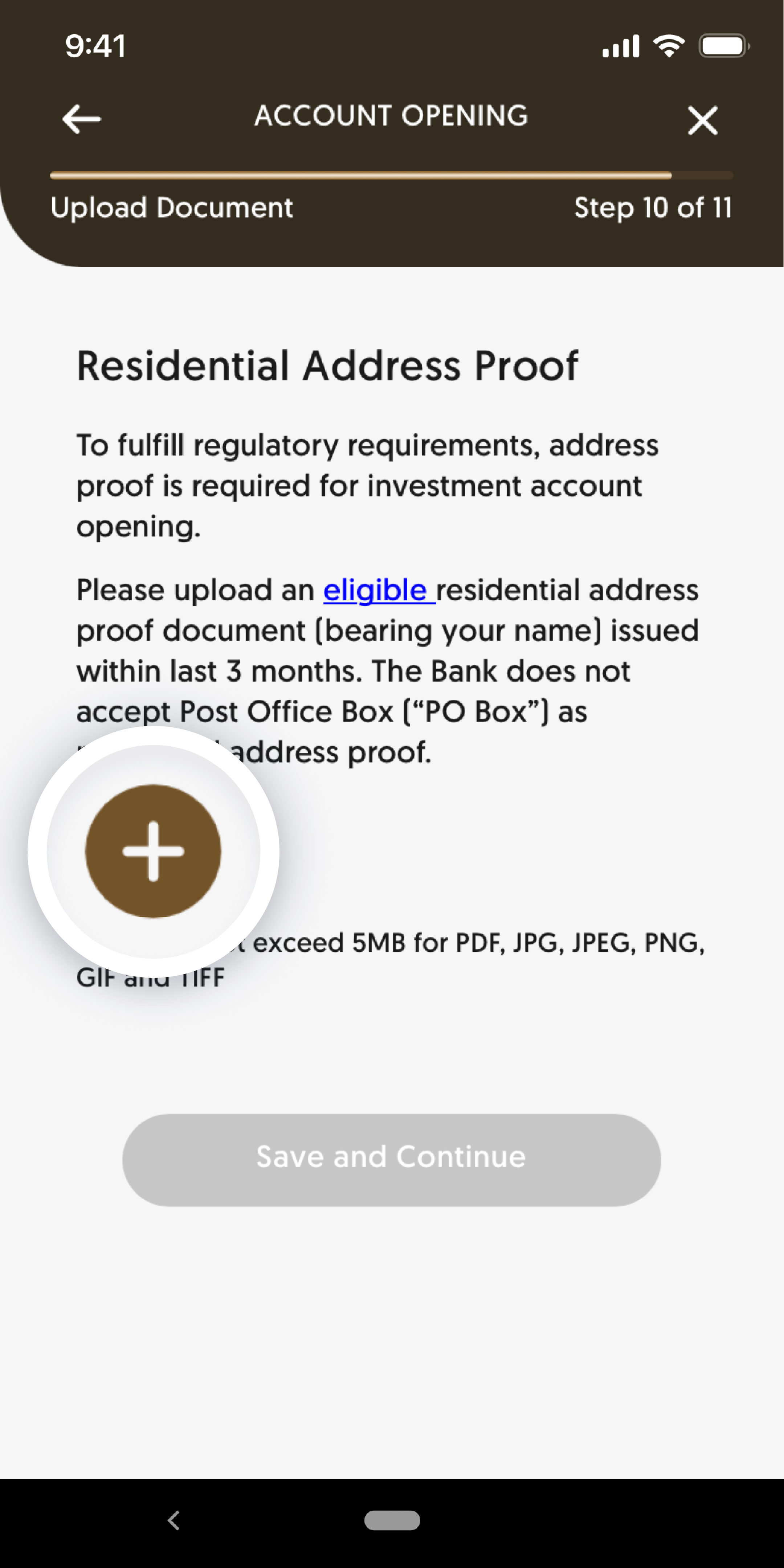

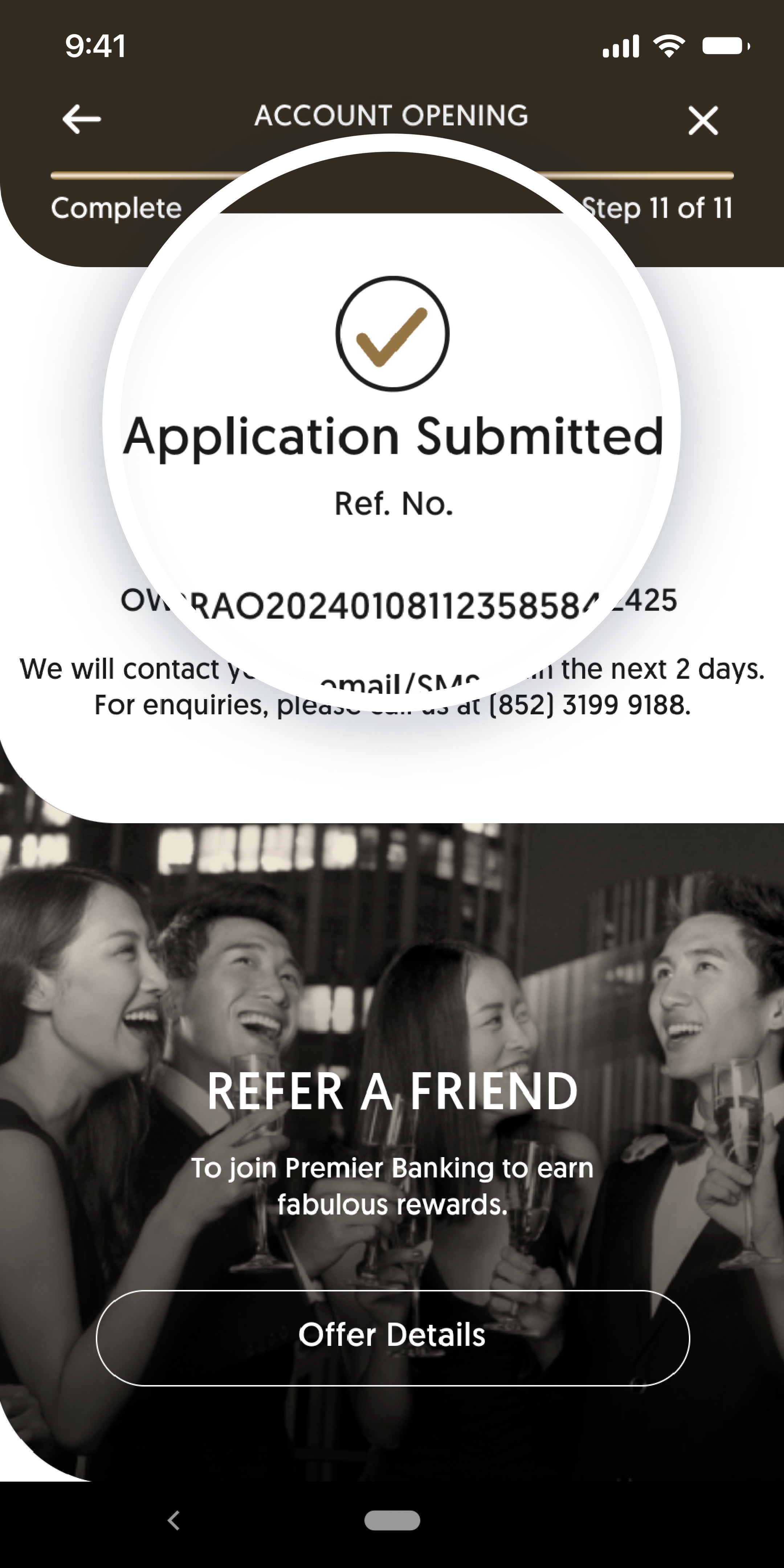

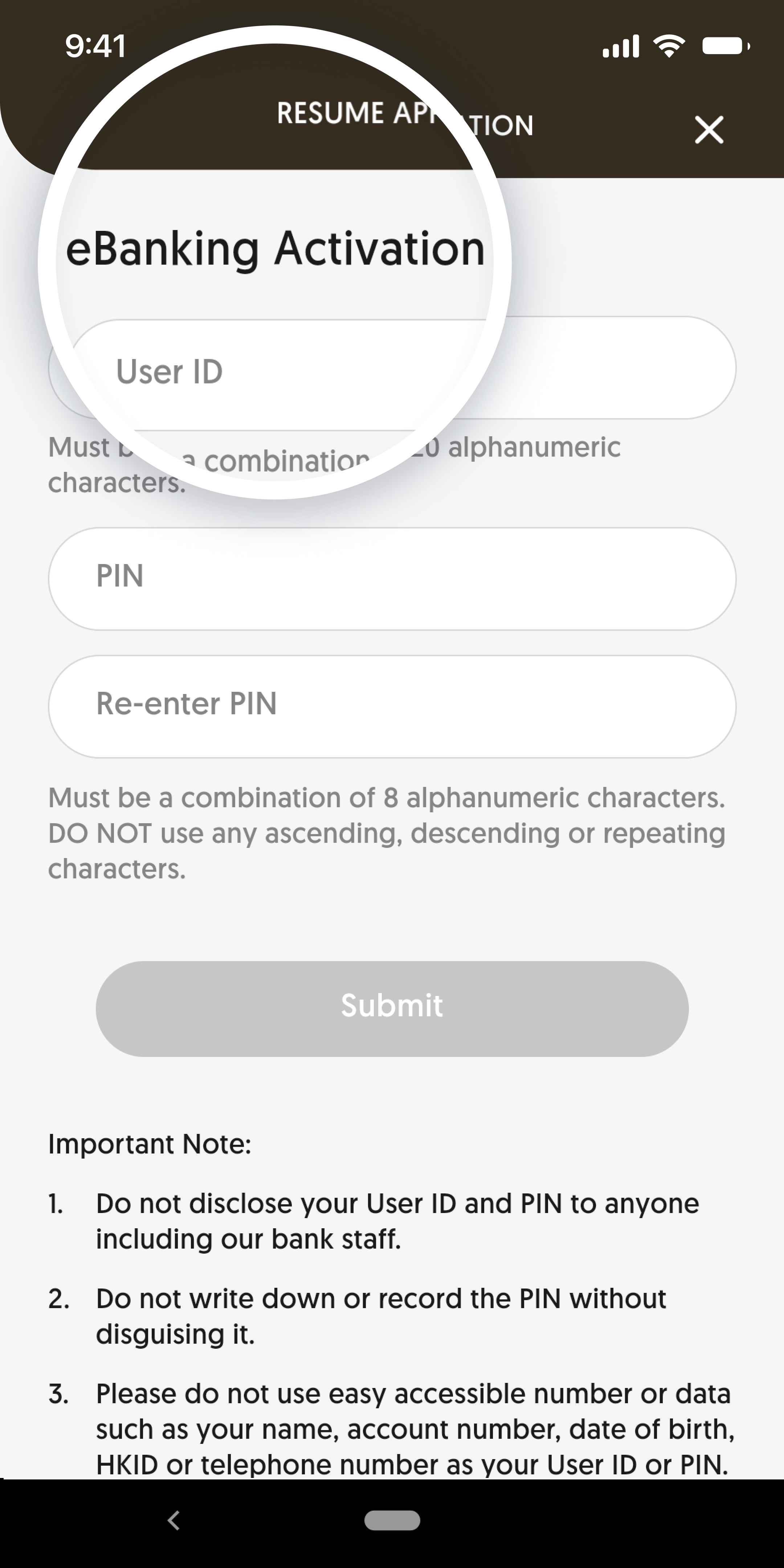

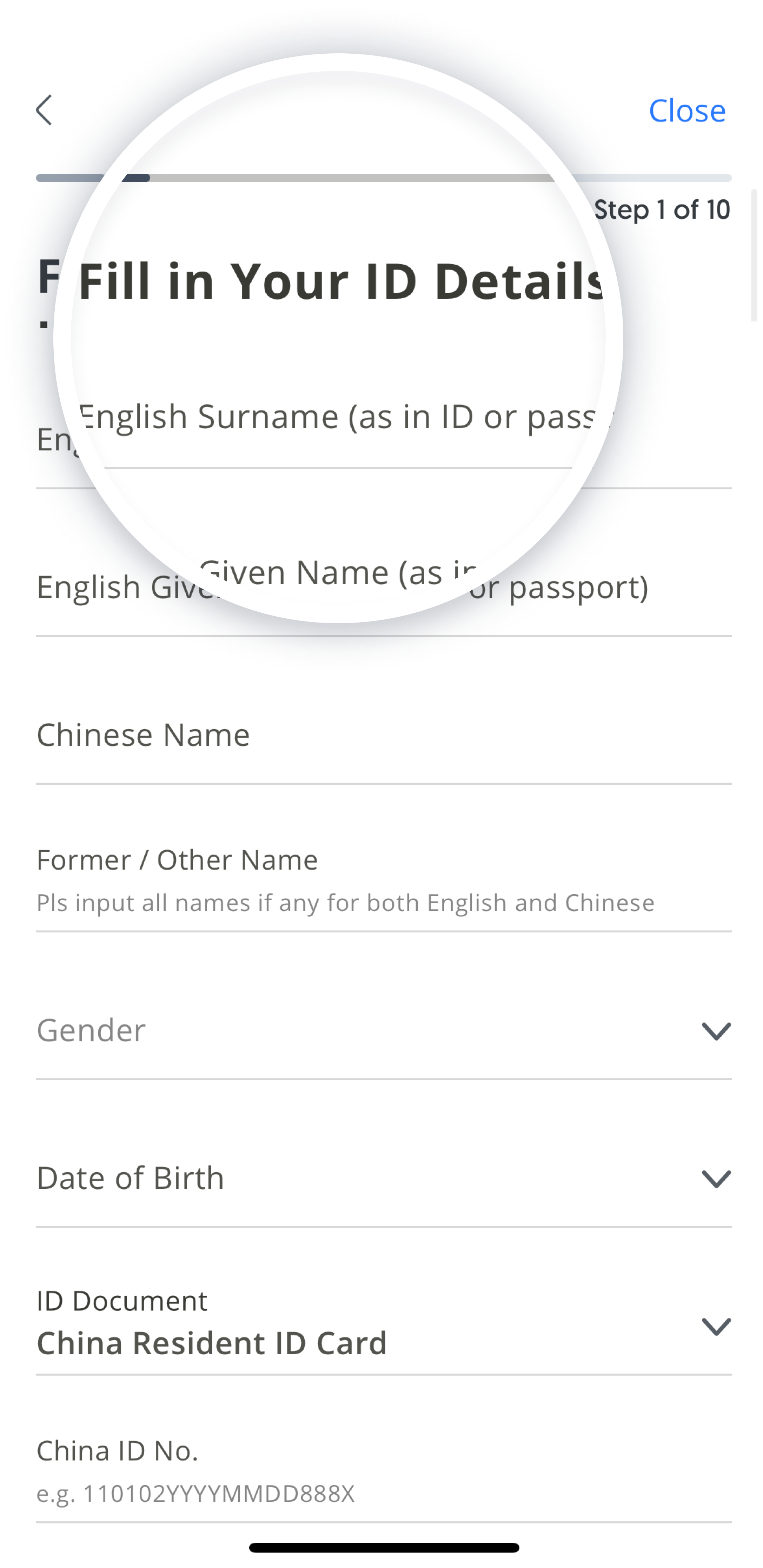

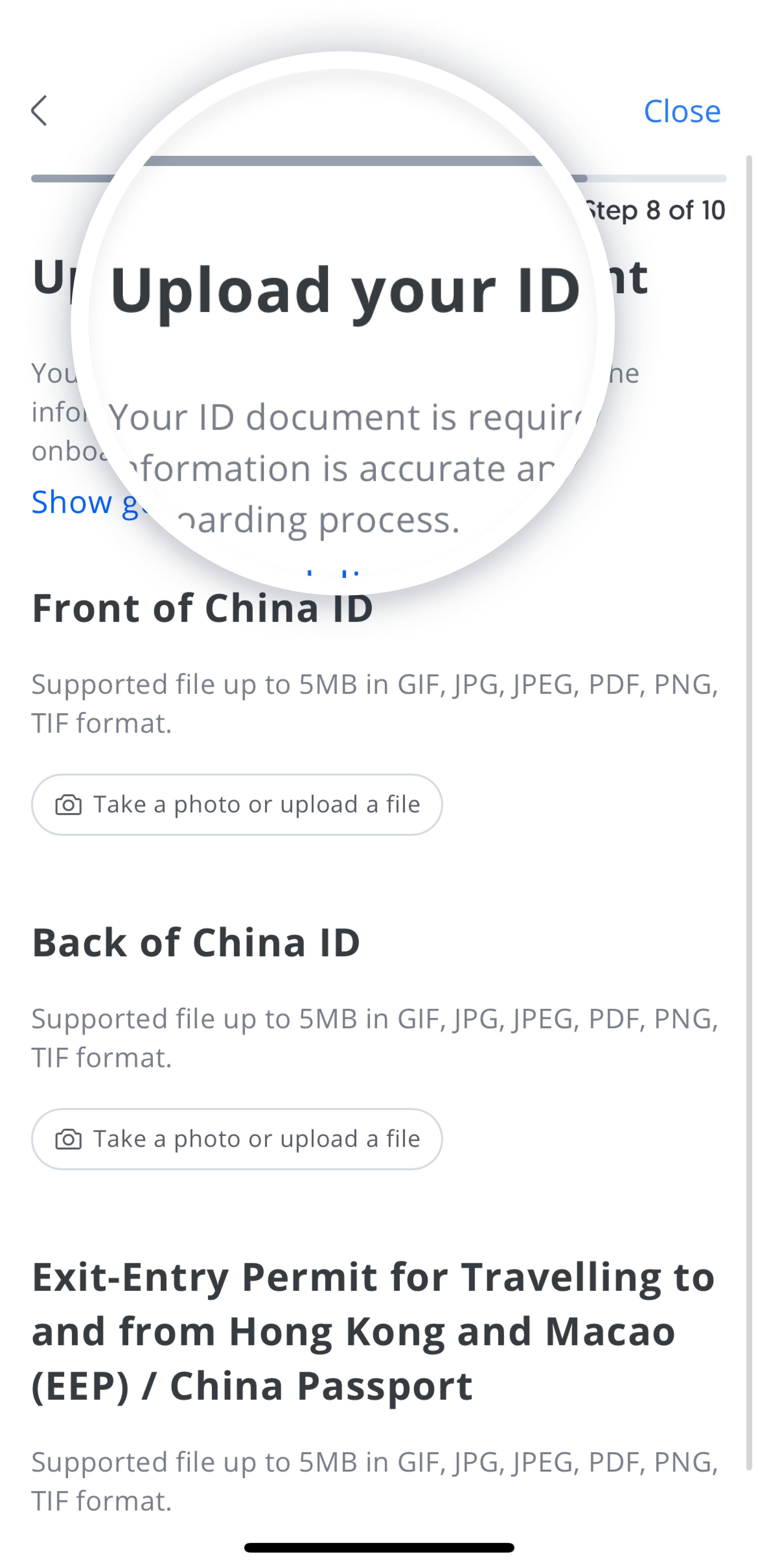

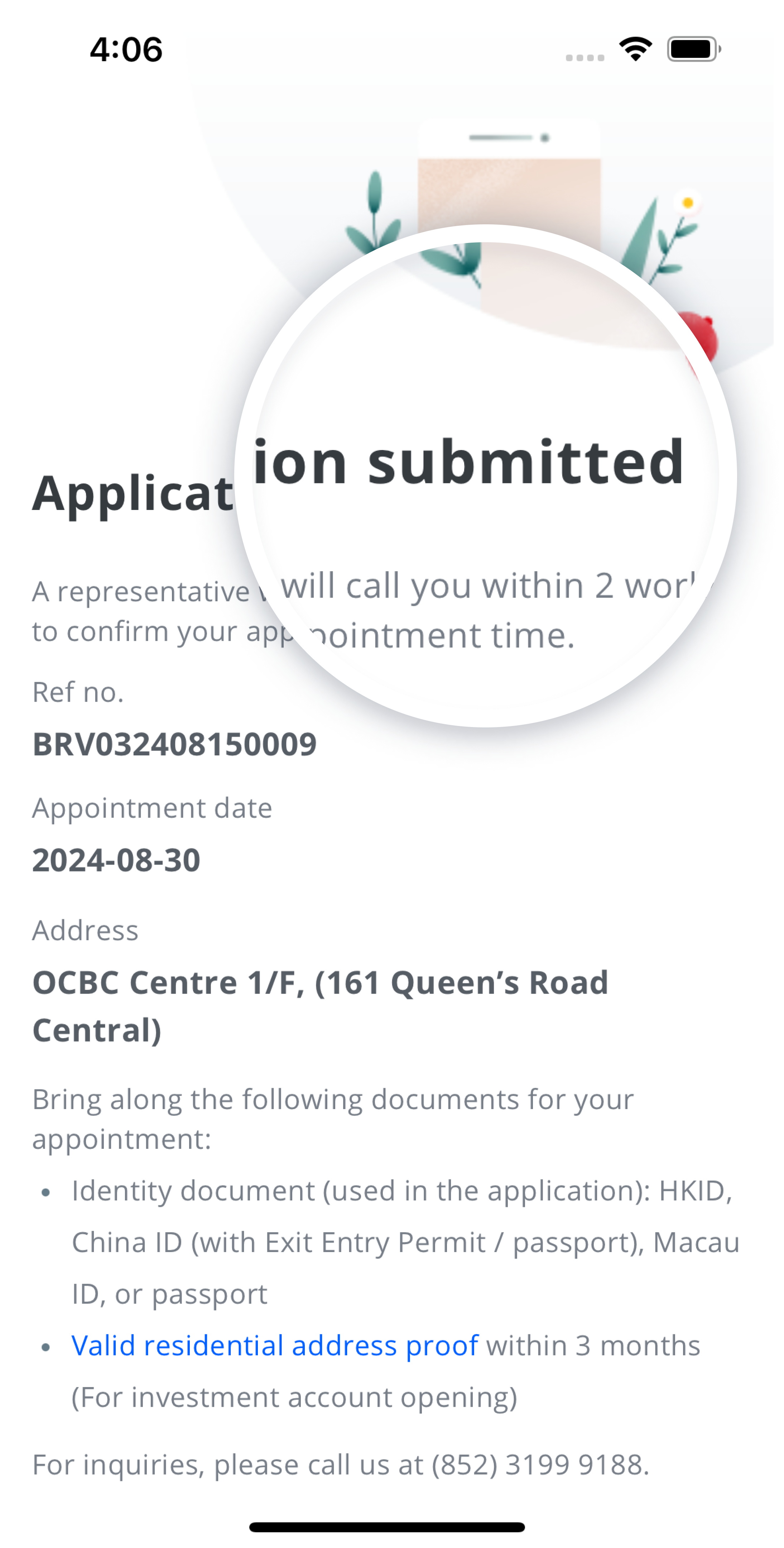

Ways to Apply

Remarks

- Exclude Multi-Currency Statement Account.

- Account can be operated through JETCO ATMs.

- Account can be operated through OCBC Bank Mobile Banking, Telematic and Internet Banking Service.

- Recipients of Comprehensive Social Security Assistance, recipients of Government Disability Allowance (customer should provide supporting documents to the Bank) and low income earners (customers are required to sign a declaration of low income earns) are exempted from the minimum initial deposit.

- For customers applied for Personal eBanking Service, you may open statement savings accounts and time deposit accounts via Internet Banking services.

- Customers are required to install Acrobat Reader and Chinese Traditional Font Pack on personal computers to view, print and download the eStatement & eAdvice in PDF format.

- When insufficient fund occurred in current account, "Easy Transfer" will transfer fund from

designated savings account to the particular current account. However, the amount of

transferred fund should not be exceeded the available

balance of the designated savings account. The transfer unit per case is at HK$1,000 or its

multiple. If the balance of savings account is less than one transfer unit, all the

available balance would be transferred to the particular

current account. (Please refer to the table below for details.)

If customer's current account is facilitated with an overdraft facility, "Easy Transfer" will first transfer required fund from the designated savings account. However, if the balance in the designated savings account is insufficient to settle related payment (i.e., example 1 & 2 of the above table), overdraft facility will be utilized.

Easy Transfer Example Example Savings Account Available Balance Amount to be Transferred Actual Transferred Amount 1 HK$800 HK$1,200 HK$800 2 HK$1,000 HK$1,200 HK$1,000 3 HK$1,500 HK$1,200 HK$1,500 4 HK$2,000 HK$1,200 HK$2,000 - Service charge of HK$100 per half year will be levied upon application and to be charged every half yearly thereafter. All charges will be debited from current account.

*Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are the registered trademarks of Google Inc..