Foreign Exchange Service

OCBC Bank provides 14 foreign currencies for your selection as well as preferential interest rates, competitive exchange rates, low exchange rates spread, pre-set buy / sell order service and longer trading hours. You may choose from savings as well as fixed deposit accounts.

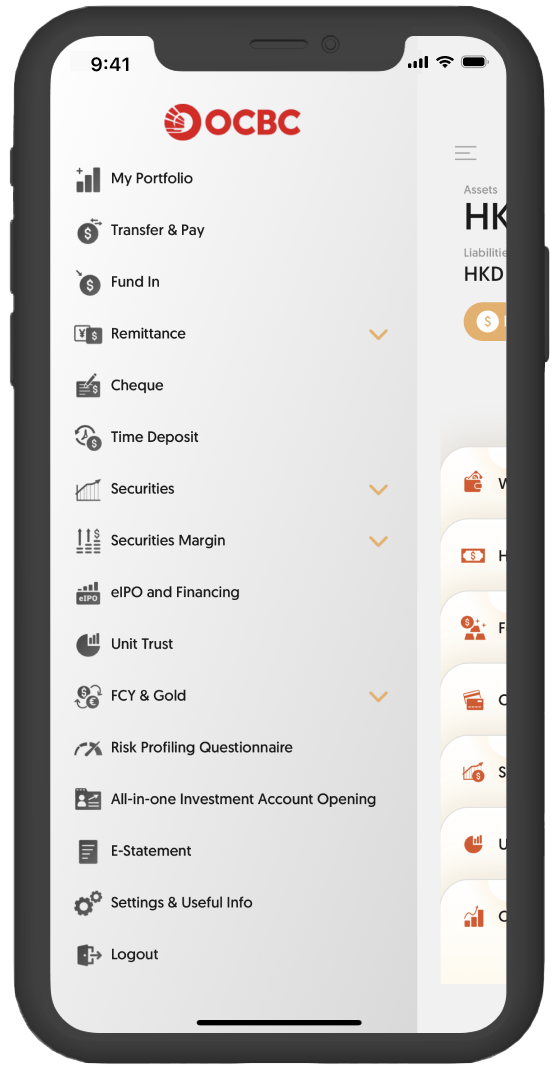

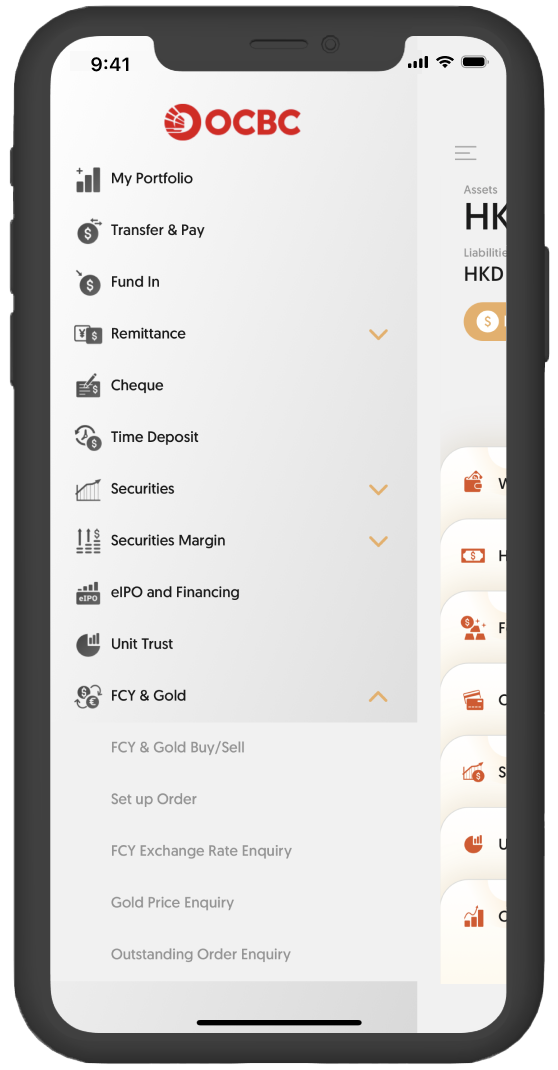

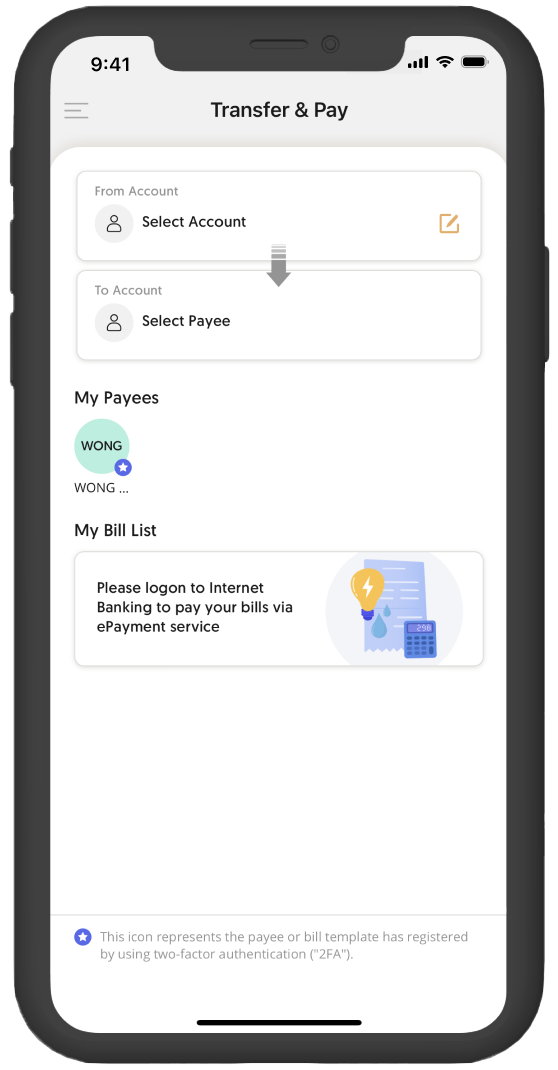

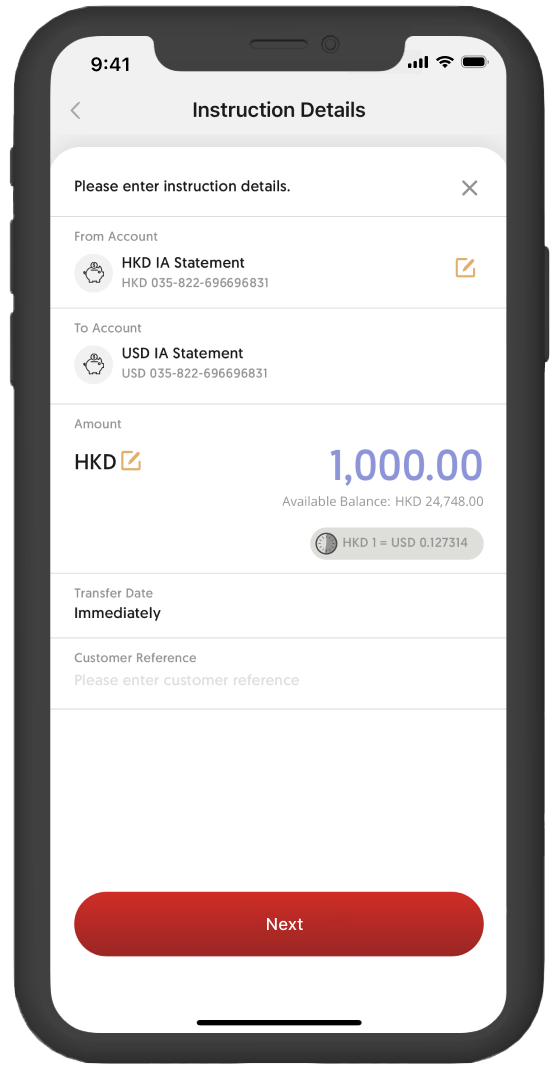

Apart from visiting our branches in person, you can buy or sell foreign currencies through internet, phone and mobile banking. To seize the best investment opportunity all the time, you can also go beyond regular office hours and make foreign exchange transactions from 9:00a.m. till the New York market closes1.

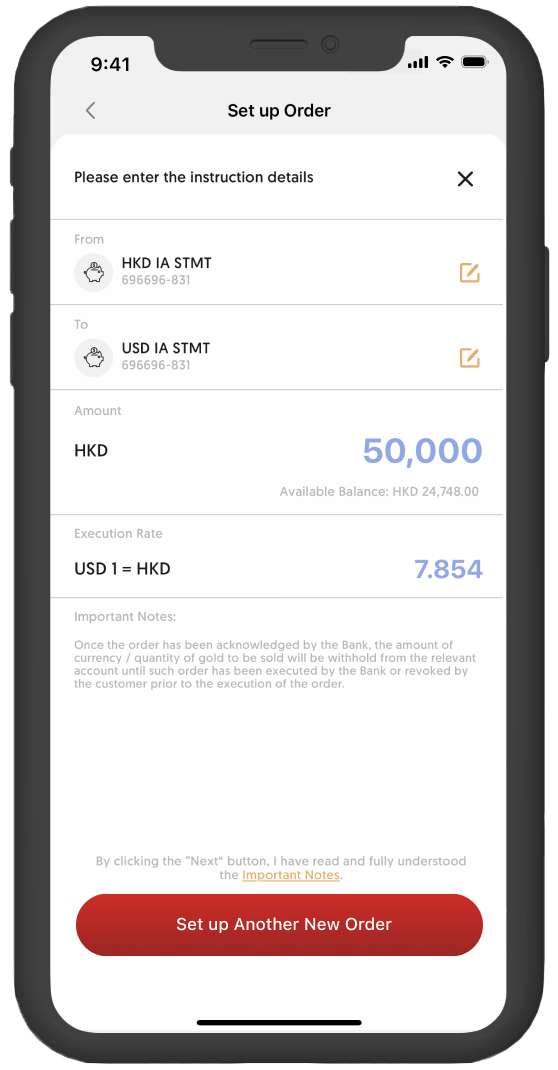

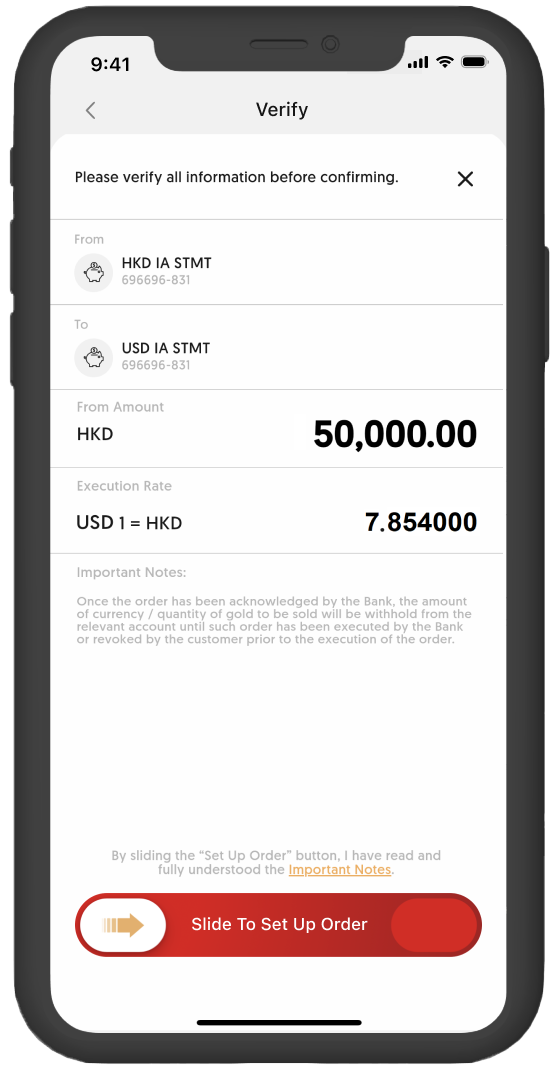

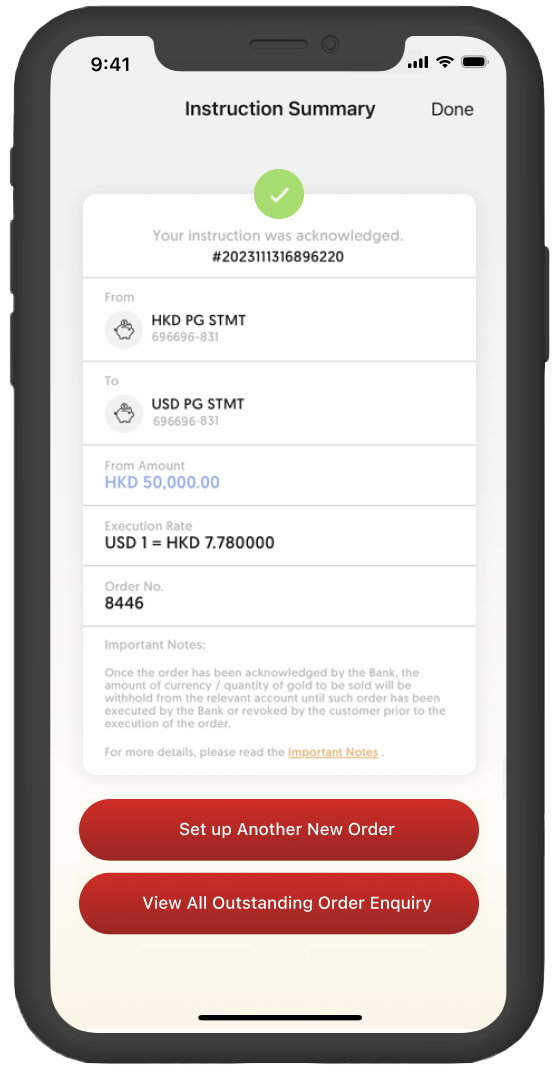

You may pre-set foreign currency buy or sell order with your desired rate and transaction amount through internet, phone and mobile banking whenever you want. With our assistance on keeping track with the market trend, the pre-set transaction will be executed automatically. Meanwhile, you can check or revoke your outstanding instructions at any time.

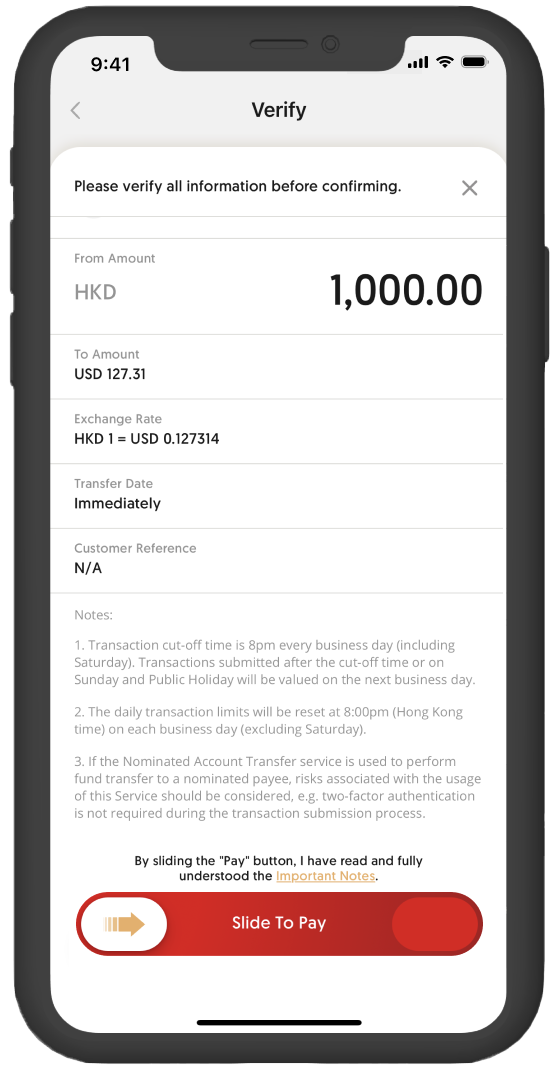

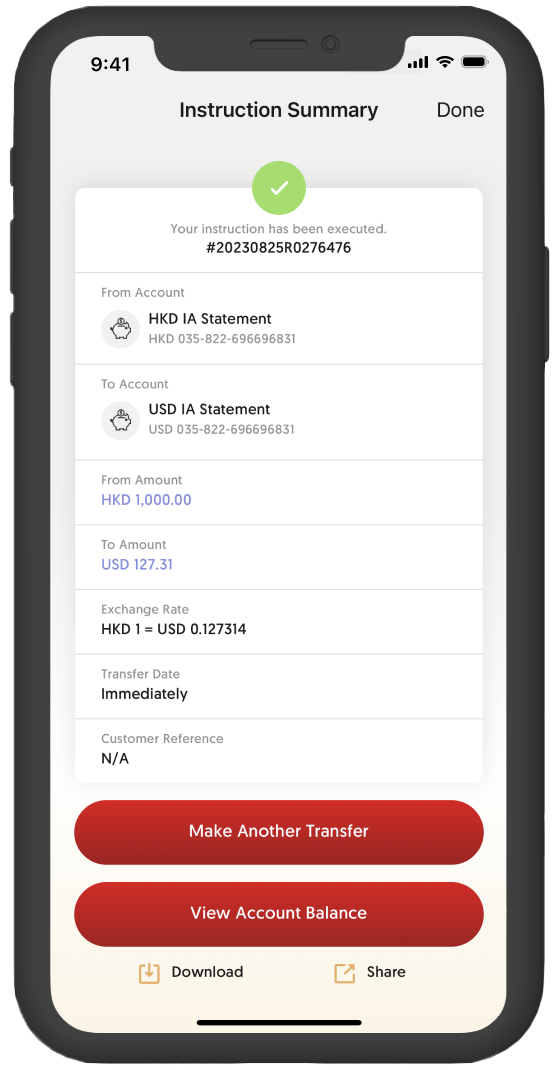

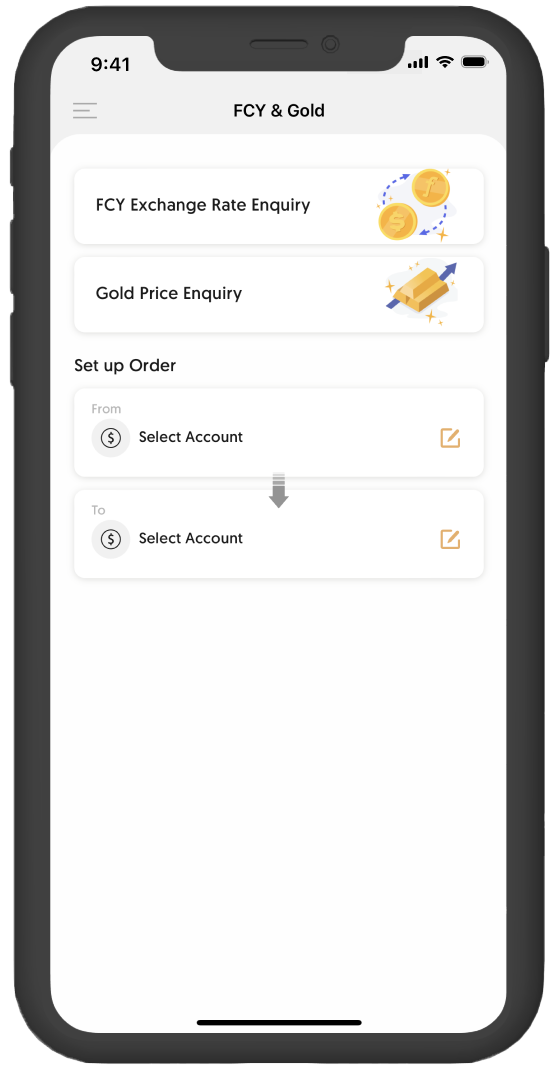

FCY Buy/Sell

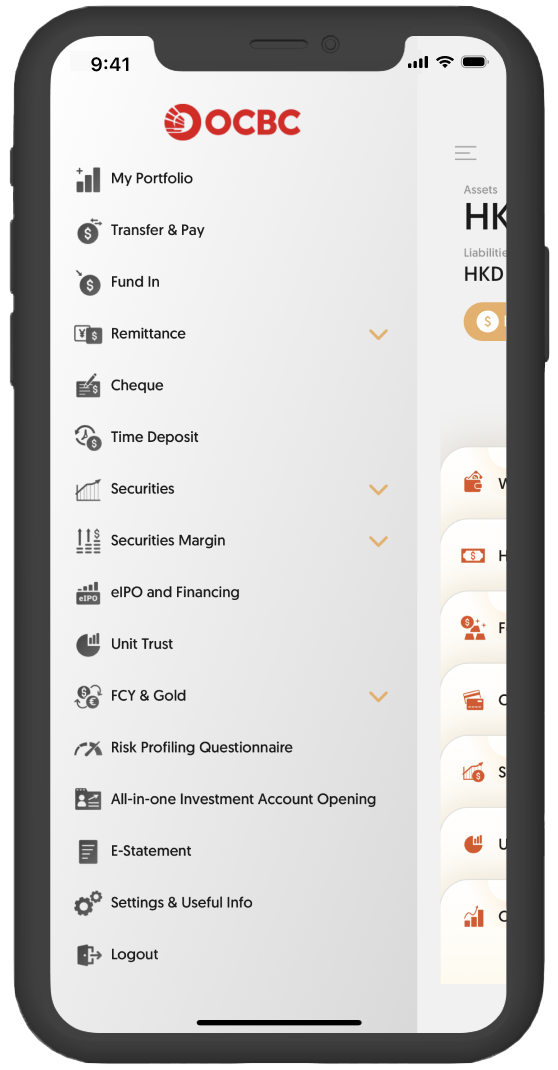

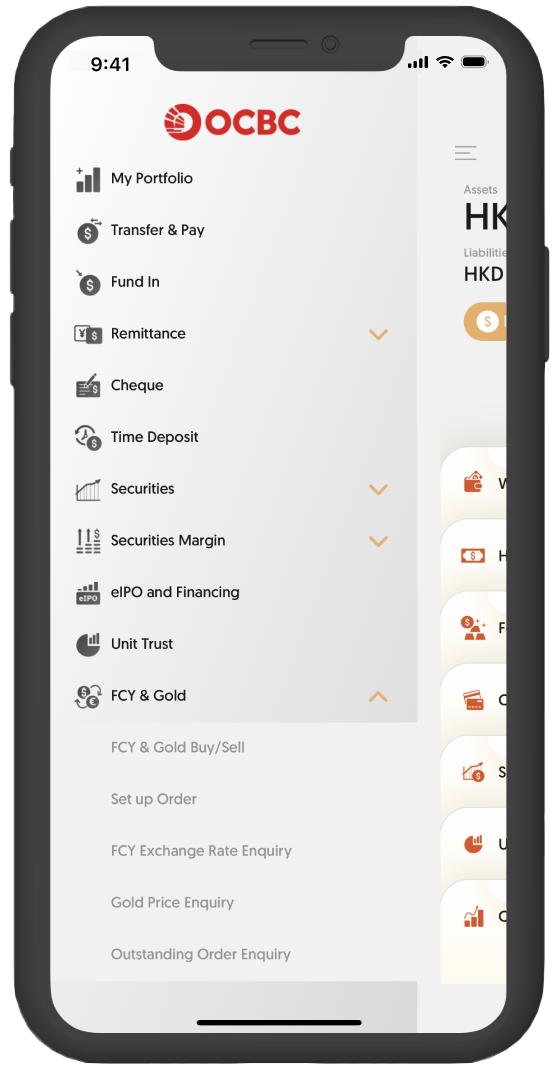

Set up Order

The information and images shown in this demo (including but not limited to the exchange rate) are provided for reference and illustration purpose only.

You may engage in a forward exchange rate contract when the exchange rate works in your favour, protecting your deposit against currency fluctuations.

Multi-Currency Deposit Account / Foreign Currency Savings Account

- Interest is calculated on a daily basis and is settled monthly to make your money grow faster.

- You can select from passbook or statement accounts.

- Multi-Currency Deposit Account can let you manage transactions up to 10 currencies including Australian Dollar, Canadian Dollar, Euro, Japanese Yen, New Zealand Dollar, Pound Sterling, Singapore Dollar, Swedish Kroner, Swiss Franc and US Dollar within one single account, enjoy the convenience of financial management.

Minimum Initial Deposit for Foreign Currency Savings Deposit (original currency) are as follows:

| Currency | Minimum Initial Deposit2 | Deposit should be over the following amount for interest | |

|---|---|---|---|

| Australian Dollar | AUD | 200 | 200 |

| Canadian Dollar | CAD | 200 | 200 |

| Swiss Franc | CHF | 200 | 200 |

| Danish Kroner | DKK | 1,000 | 1,000 |

| Euro | EUR | 200 | 200 |

| Pound Sterling | GBP | 200 | 200 |

| Japanese Yen | JPY | 20,000 | 20,000 |

| Norwegian Kroner | NOK | 1,000 | 1,000 |

| New Zealand Dollar | NZD | 200 | 200 |

| Renminbi | RMB | 2,000 | 2,000 |

| Swedish Kroner | SEK | 1,000 | 1,000 |

| Singapore Dollar | SGD | 200 | 200 |

| Thailand Baht | THB | 4,000 | 4,000 |

| US Dollar | USD | 200 | 200 |

Foreign Currency Fixed Deposit

- Enable you to capture higher interest return and exchange rate movement.

- Deposit tenor ranges from 7 days to 6 months.

- You can preset the account for fund transfer upon its maturity or select to roll over automatically through internet, phone and mobile Banking.

Minimum Initial Deposit for Foreign Currency Fixed Deposit (original currency) are as follows:

| Currency | Over-the-Counter Minimum Initial Deposit | Minimum Initial Deposit via Internet / Telematic Banking / Mobile Banking | ||

|---|---|---|---|---|

| Currency | Below One-Month | One-Month or above | Minimum Initial Deposit via Internet / Telematic Banking / Mobile Banking | |

| Australian Dollar | AUD | 15,000 | 7,500 | 1,000 |

| Canadian Dollar | CAD | 15,000 | 7,500 | 1,000 |

| Renminbi | CNY | N/A | 20,000 | 20,000 |

| Danish Kroner | DKK | 75,000 | 37,500 | 5,000 |

| Japanese Yen | JPY | 1,500,000 | 750,000 | 100,000 |

| New Zealand Dollar | NZD | 20,000 | 10,000 | 1,000 |

| Norwegian Kroner | NOK | 75,000 | 37,500 | 5,000 |

| Singapore Dollar | SGD | 20,000 | 10,000 | 1,000 |

| Swedish Kroner | SEK | 75,000 | 37,500 | 5,000 |

| Swiss Franc | CHF | 15,000 | 7,500 | 1,000 |

| Thailand Baht | THB | 300,000 | 150,000 | 20,000 |

| Pound Sterling | GBP | 7,500 | 3,750 | 500 |

| US Dollar | USD | 12,500 | 12,500 | 12,500 |

| Euro | EUR | 10,000 | 5,000 | 1,000 |

USD Current Account

- You can settle your local USD transactions by using USD cheque and CHATS. No exchange premium will be incurred.

- Free cheque book.

- Monthly statement showing details of each transaction will be provided.

- Overdraft facilities will be offered upon request.

- Initial deposit amount as low as US$2002.