| 1. |

Introduction of Business eBanking |

| Q: |

What is Business eBanking? |

| A: |

Business eBanking

is an innovative and integrated banking services for

corporate users to manage their account activities through

the use of Internet and telephone.

With Business eBanking,

you can manage your corporate finances such as account

enquiry and fund transfer at anytime, anywhere and

anyhow.

|

| |

|

|

| |

| Q: |

What kind of the banking services that are

available through Business eBanking? |

| A: |

You can manage your company accounts with the following

Business eBanking:

Transaction Status Enquiry

Transaction Status Enquiry

Account Enquiry

Account Enquiry

Fund Transfer

Fund Transfer

Credit Card Payment

Credit Card Payment

Foreign Currency & Gold Buy / Sell Order

Foreign Currency & Gold Buy / Sell Order

ePayment (Bill Payment)

ePayment (Bill Payment)

Electronic Bill Presentment & Payment Service

Electronic Bill Presentment & Payment Service

Time Deposit (Enquiry, Setup, Renewal and Withdrawal,

Change of Maturity Instruction)

Time Deposit (Enquiry, Setup, Renewal and Withdrawal,

Change of Maturity Instruction)

Rate Enquiry (Deposit Rates, Exchange Rates and Gold Prices)

Rate Enquiry (Deposit Rates, Exchange Rates and Gold Prices)

Remittance (Telegraphic Transfer, CHATS and HK-Macau Instant Remittance)

Remittance (Telegraphic Transfer, CHATS and HK-Macau Instant Remittance)

Trade Services (Credit Limit Utilization Enquiry, Letter of Credit (L/C)

Application and Amendment)

Trade Services (Credit Limit Utilization Enquiry, Letter of Credit (L/C)

Application and Amendment)

Payroll

Payroll

Upload Payroll Instruction Service*

Upload Payroll Instruction Service*

Upload Batch Payment Instruction Service*

Upload Batch Payment Instruction Service*

Cheque Services (Stop Cheque Payment and Cheque Status

Enquiry)

Cheque Services (Stop Cheque Payment and Cheque Status

Enquiry)

e-Cheque Services

e-Cheque Services

Other Services (Change of User ID and PIN)

Other Services (Change of User ID and PIN)

Cheque Book Requisition

Cheque Book Requisition

Securities Trading

Securities Trading

Foreign Exchange Margin Trading (Margin Deposit / Withdrawal)

Foreign Exchange Margin Trading (Margin Deposit / Withdrawal)

*Not applicable to mobile devices, please access by personal computers.

|

| |

|

|

| |

| Q: |

How can I apply for Business eBanking? |

| A: |

You can visit any of our

branches to apply.

Also, you may contact our Customer Service Hotline at

3199 9188 for details.

|

| |

|

|

| |

| Q: |

What are the Service Hours, Cut-off Time

and Value Date of Business eBanking? |

| A: |

| Service

Type |

Service Hours |

Cut-off Time /

Value Date |

|

General Banking Services

- Account Enquiry

- Fund Transfer

- Credit Card Payment

- Nominated Account Transfer - "NACT" within OCBC Bank

- Rate Enquiry

- Online Requisition

|

24 hours |

20:00 / same day value |

| Nominated Account Transfer-"NACT" to other banks^ |

24 hours |

Mon - Fri: 14:30

/ same day value |

| Nominated Account Transfer-"NACT" from other banks^ |

24 hours |

Mon - Fri: 20:00

/ same day value |

| ePayment^ |

24 hours |

Mon - Fri: 17:00

/ same day value

Payment or donation via Electronic Bill Presentment & Payment Service

Mon - Fri: 12:30

/ same day value

|

Time Deposit

- Confirmation Enquiry

- Placement, Renewal, Withdrawal, Change of Maturity Instruction

|

- 24 hours

- Mon - Fri: 9:00 - 20:00

| 20:00 / same day value |

| e-Cheque Issuance |

24 Hours |

Immediately |

| Stop Cheque Payment |

Mon - Sat: 8:00 - 20:00 |

20:00 / same day value |

| Foreign Exchange |

Mon - Fri: 9:00 - 2:30 / [3:30]*

Sat: 9:00 - 13:00#

|

20:00 / same day value |

| Gold Trading |

Mon - Fri: 9:00 - 2:30 / [3:30]* |

20:00 / same day value |

| Renminbi (CNH) Services |

Mon - Fri: 9:00 - 17:00

Sat: 9:00 - 13:00#

Sun and Hong Kong public holiday: N/A |

Mon - Fri: 17:00

Sat: 13:00

/ same day value |

| Overnight Plus Deposit Account Services |

Mon - Fri: 9:00 - 16:00

Sat, Sun and Hong Kong public holiday: N/A |

16:00 / same day value |

|

Trade Services

- L/C Application and Amendment

- Credit Limit Utilization Enquiry

|

24 hours

Mon - Fri: 9:00 - 18:00

Sat: 9:00 - 13:00

|

|

|

| Payroll^ |

24 hours |

Mon - Fri: 19:30

Sat: 13:00 (within OCBC Bank)

Same day value |

| Telegraphic Transfer^ |

24 hours |

Renminbi: Mon - Fri 15:00

Other Currencies: Mon - Fri 15:00

/ same day value |

| CHATS^ |

24 hours |

Mon - Fri: 15:00

/ same day value |

| HK-Macau Instant Remittance |

24 hours |

Mon - Sat: 20:00

/ same day value |

| Other Services - Change of User

ID & PIN |

24 hours |

Immediately |

| Upload Payroll Instruction Service ^ |

24 hours |

Mon - Fri: 12:00

/ same day value |

| Upload Batch Payment Instruction Service ^ |

24 hours |

Mon - Fri: 12:00

/ same day value |

| Securities Trading |

Trading Day: 9:30 - 16:10

Preset Instruction: 18:00 - 9:15 (next trading day)

|

Immediately (during Trading Hours)

9:15 (Pre-Market Session)

16:10

|

| Foreign Exchange Margin Trading (Margin Deposit / Withdrawal) |

Mon - Fri: 9:00 - 2:30 / [3:30]*

Sat: 9:00 - 13:00# |

20:00 / same day value |

- Business eBanking Services are not available for approximately half an hour from 8:00pm on each business day for data update.

* New York Winter Time

# Service is not available if Saturday is also a Hong Kong public holiday.

^ Instruction submitted after cut-off time will be executed on the next business day excluding Saturday.

|

| |

|

|

| |

| Q: |

How many types of users does Business eBanking provide? |

| A: |

There are two types of users: Primary

User(PU) and Secondary User(SU). |

| |

|

|

| |

| Q: |

What are the responsibilities of different

user types? |

| A: |

A Primary User is responsible for administrating company

profile, such as maintaining company account profile

and reducing transaction limits according to your business

needs. Moreover, a PU is also responsible for creating

and maintaining the functional profile of Secondary

User.

A Secondary User is responsible for submission, approval,

cancellation of transaction and also enquiry of a banking account balance

regarding to his/her own functional profile.

|

| |

|

|

| |

| Q: |

What is the maximum number of PU and SU for a company? |

| A: |

A company can register 2 PUs and 99 SUs. |

| |

|

|

| |

| Q: |

Can I be a PU and SU at the same time? |

| A: |

Yes. You are allowed to be PU and SU

at the same time according to your business needs. |

| |

|

|

| |

| 2. |

Transaction Status Enquiry |

| Q: |

How can I enquire the approval status of submitted instruction? |

| A: |

You can enquire the approval status of submitted instruction by accessing

the "Pending Instruction Enquiry".

|

| |

|

|

| |

| Q: |

How can I enquire the details of

submitted forward date instruction? |

| A: |

You can enquire the details of submitted forward date instruction by accessing

the "Forward Date Instruction".

|

| |

|

|

| |

| Q: |

How can I enquire the result of

submitted forward date instruction? |

| A: |

You can enquire the result of submitted forward date instruction by accessing

the "Message Box"

and "Forward Date Instruction". |

| |

|

|

| |

| 3. |

Account Enquiry |

| Q: |

How can I check the balances

of my registered accounts? |

| A: |

You can enquire your registered accounts balance details

and transaction history by clicking the "Account

Enquiry" button. |

| |

|

|

| |

| Q: |

What is the maximum day of transaction history

I can attain for my registered accounts? |

| A: |

You can enquire the last 60 days activities for Current, Passbook Savings, Statement Savings, Overnight Plus, Foreign Exchange Margin Trading, and Securities accounts, and up to last statement date activities for Credit Card account. |

| |

|

|

| |

| Q: |

Can I enquire the transaction performed today? |

| A: |

Yes, you can enquire the transaction through "Today

Activities".

|

| |

|

|

| |

| 4. |

Fund Transfer |

| Q: |

What should I pay attention to before confirming a fund transfer instruction? |

| A: |

Verify carefully the transferee's account number and transfer amount (and the account name if available) before confirming a fund transfer instruction.

In case of any transfer to a wrong account by mistake, contact the transferor's bank for assistance as soon as possible. However, the transferee's bank may only return the fund back to the transferor's bank upon getting the transferee's consent.

If the transferee is not cooperative or refuses to return the fund, the transferor should consider reporting the case to the police. Besides, anyone who discovers a deposit to his bank account from an unknown source and does not return the fund, he may be criminally liable. |

| |

|

|

| |

| Q: |

How can I know the fund transfer instruction

is accepted by the Bank? |

| A: |

A confirmation message is displayed on the screen, when your instruction is accepted by the Bank. |

| |

|

|

| |

| Q: |

What is the Maximum Daily Transaction

Limit of Business eBanking? |

| A: |

The Maximum Daily Transaction

Limit are as follows: |

| |

| Services |

Maximum Daily Transaction

Limit (HKD Equivalent) |

| Internal Fund Transfer |

50,000,000# |

Transfer to

Pre-registered Account |

NACT |

1,000,000 |

Telegraphic Transfer

Telegraphic Transfer

HK-Macau Instant Remittance

HK-Macau Instant Remittance

|

10,000,000 |

| CHATS |

10,000,000 |

ePayment

(shared with EBPP payment and donation)

|

ePayment Total Limit |

100,000* |

| Sub-limit for payment to "Primary or Secondary Education", "Post-secondary or Specialised Education", "Government or Statutory Organization" and "Public Utility" |

100,000* |

| Sub-limit for payment to other merchants |

50,000* |

| Payroll

Service |

3,000,000 |

| Transfer to Non-registered Account |

Transfer to Other Local Bank Accounts

Transfer to Other Local Bank Accounts

|

50,000 |

Transfer to Other OCBC Bank Accounts

Transfer to Other OCBC Bank Accounts

Telegraphic Transfer

Telegraphic Transfer

CHATS

CHATS

HK-Macau Instant Remittance

HK-Macau Instant Remittance

e-Cheque Issuance

e-Cheque Issuance

|

2,000,000%^ |

| "Upload Payroll Instruction Service" and "Upload Batch Payment Instruction Service" |

2,000,000^ |

*ePayment Service Total Limit is shared among all payment types.

#Maximum exchange limit for each foreign currency and gold exchange transaction is HKD1,000,000 or equivalent. Minimum transaction limit for foreign currency exchange is HK$20 or equivalent. The calculation for equivalent HKD is based on the average exchange rate of the withdrawal currency during the previous business day.

^Only applicable to customer who has applied eCertificate Service

%Only applicable to customer who has applied Security Device

|

| |

|

|

| |

| Q: |

Can I reduce the daily limit myself? |

| A: |

Yes, the PU can reduce the transaction

daily limit by accessing Banking Service Maintenance

page from the section of Company Administration and Enquiry.

However, it is necessary to submit a

Business eBanking Services - Company Profile Alteration Request Form to restore the reduced transaction daily limit

and submit to any of our

branches. |

| |

|

|

| Q: |

Can I input any special characters in Customer Reference? |

| A: |

Only alphanumeric characters are allowed. |

| |

|

|

| |

| Q: |

What if my PC gets disconnected from the Internet

in the transaction processing by accident? How will I know whether that

transaction has been completed or not? |

| A: |

All successful transactions will be given a transaction

reference number for your record. If a transaction reference number is not

given, please re-login to Internet Banking Services and check the

transaction history, account balances and today transaction activities

through the "Account Enquiry" and "Today Activities" under "Account Services".

Should you have any doubts or questions, please call our Customer Services Hotline

at 3199 9188. |

| |

|

|

| Q: |

How long I can place my forward date instruction?

|

| A: |

You can set your forward date instruction

up to 45 calendar days. |

| |

|

|

| |

| Q: |

Do I need to have sufficient fund in

the debit account at the time I set a forward date instruction?

What will be happened if there is insufficient fund in the

debit account on the execution date? |

| A: |

It is not necessary to have sufficient

fund in your account at the time you make a forward date

instruction. However, you should make sure that you have

the required amount in the debit account one day prior to the execution date. |

| |

|

|

| |

| Q: |

Can I cancel the forward date instruction

before the execution date? |

| A: |

Yes, you can cancel the forward date

instruction at least one calendar day prior to the execution

date. |

| |

|

|

| |

| Q: |

What is Nominated Account Transfer "NACT"? |

| A: |

NACT enables customers to transfer fund to or collect fund from pre-registered third party accounts (including OCBC Bank accounts and other local bank accounts) via Internet Banking or Mobile Banking (applicable to personal customers only). |

| |

|

|

| |

| Q: |

When will the fund to be credited to the

beneficiary's account for NACT? |

| A: |

For transferring fund to other bank's account, if the NACT instruction is submitted before the cutoff time (Please refer to the Service Hour Table) every business day (excluding Saturday), fund will be credited to the payee's account at the same business day (subject to the payee's bank arrangement). If the payee's account is maintained at OCBC Bank, the payment will be effected immediately.

Collection of fund from other bank's account will generally take 3 business days excluding Saturday, subject to the collection of fund by OCBC Bank.

|

|

|

|

| |

| Q: |

Can I make card payment through OCBC Business eBanking? |

| A: |

Yes, you can make card payment to your

registered OCBC Bank Corporate Credit Card Account. |

| |

|

|

| |

| 5. |

Foreign Currency & Gold Buy / Sell Order |

| Q: |

Is there any limitation for placing a Foreign Currency & Gold

Buy / Sell order? |

| A: |

Yes, the buy / sell rate cannot be placed higher or lower than

5 % of the prevailing rate. Further, the exchange rate and gold price stored must

be in multiple of 0.001 and 5 respectively, except GBP which is in 0.005 and JPY which

is in 0.0001. Besides, the orders will be executed from Monday to Friday during the

service hours when the Bank's rate quotation for such currency or gold is available

at the time. |

| |

|

|

| |

| Q: |

Is there any minimum transaction requirement

for placing a Foreign Currency & Gold Buy / Sell order? |

| A: |

Yes, the transaction amount of buy/sell

order are restricted as follows:

| Currency / Gold |

Minimum Withdrawal Amount |

Increment in Multiple of |

HKD RMB

|

50,000 |

5,000 |

| GBP EUR |

5,000 |

500 |

USD CAD AUD CHF NZD SGD

|

10,000 |

1,000 |

NOK SEK DKK

|

50,000 |

5,000 |

| THB |

200,000 |

20,000 |

| JPY |

1,000,000 |

100,000 |

| 99 Gold / 9999 Gold |

5 Taels |

1 Tael |

| Gold Maple Leaf / Ounce Gold |

5 Ounces |

1 Ounce |

|

| |

|

|

| |

| 6. |

eStatement & eAdvice Service

|

|

|

| Q: |

What is eStatement & eAdvice service? |

| A: |

To encourage green living and paper saving,

OCBC Bank introduces eStatement & eAdvice Service,

enabling customers to view, print and download account statements

and advices via Internet Banking. Enjoy this secure and convenient

service and protect the environment. |

| |

|

|

| |

| Q: |

What account types are eligible for eStatement & eAdvice service? |

| A: |

Our eStatement & eAdvice Service covers a wide of account types, including but not limited to:

| Category |

Account Types |

| Banking |

- Current Account Statement

- Statement Account Statement

- Multi-currency Statement Account Statement

- Overnight Plus Account Statement

- Integrated Account Statement

- Premier Banking Statement

|

| Investment |

- Investment Account Statement

- Securities Account Statement

- Daily Activities of Investment Account

- Contract Note

- Consolidated Share Trading Advice and Receipt

- Securities Receipt And Credit/Debit Advice

- Securities Receipt And Credit/Debit Advice (IPO)

- Confirmation of Structured Deposit

- Daily Activities of Structured Deposit Account

|

| Card |

- Credit Card Account Statement

- Cash Card Account Statement

- e-Money Loan Card Account Statement

- Revolving Credit Account Statement

|

|

| |

|

|

| |

| Q: |

Is there any charge for using eStatement & eAdvice Service? |

| A: |

Our eStatement & eAdvice Service is free of charge. |

| |

|

|

| |

| Q: |

Do I need to register for eStatement & eAdvice Service? |

| A: |

This service is only applicable for customers of Business eBanking and the relevant account(s) should be added to the Business eBanking service. |

| |

|

|

| |

| Q: |

How can I view my eStatement & eAdvice? |

| A: |

Simply logon to Internet Banking to view, print and

download the past 12 months' eStatement and the recent 3 months' eAdvice anytime anywhere. |

| |

|

|

| |

| Q: |

How long can I view my past eStatement & eAdvice? |

| A: |

You can view, print and download the past 12 months' eStatement

and the recent 3 months' eAdvice via our Internet Banking. |

| |

|

|

| |

| Q: |

How can I discontinue / resume mailing of paper statements & advices? |

| A: |

Personal customers can register to "Discontinue Paper Statement & Advice" via

Internet Banking. Besides, customers can submit a Discontinuation / Resumption of Statements and Advices Mailing Service Form to any of our branches to discontinue/resume paper statement & advice.

Corporate customers can submit a Discontinuation / Resumption of Statements and Advices Mailing Service Form to any of our branches to discontinue/resume paper statement & advice.

Instruction submitted will become effective within 3 business days.

Discontinuation of mailing service is on account basis. Once the instruction is effective, all statements and advices associated with the account number will no longer be mailed. Besides, please register email address to receive reminder email, notifying you that the latest statement is ready on Internet Banking. |

| |

|

|

| |

| Q: |

Will I receive email notification reminding me the latest statement is ready on Internet Banking? |

| A: |

Free email notification is only applicable to customers who have registered to "Discontinue Paper Statement & Advice". |

| |

|

|

| |

| Q: |

Is using eStatement & eAdvice safe? |

| A: |

eStatement & eAdvice are encrypted to protect customers' privacy. |

| |

|

|

| |

| Q: |

Do I need to install any software in order to view eStatement & eAdvice? |

| A: |

Customers are required to install Acrobat Reader and Chinese Traditional Font Pack on personal computers to view, print and download the eStatement & eAdvice in PDF format. |

| |

|

|

| |

| 7. |

Time Deposit

|

|

|

| Q: |

What types of time deposit services are

available? |

| A: |

Time Deposit Confirmation Details Enquiry

Time Deposit Confirmation Details Enquiry

Setup New Time Deposit Setup New Time Deposit

Time

Deposit Renewal Time

Deposit Renewal

Time

Deposit Withdrawal Time

Deposit Withdrawal

Change

of Maturity Instruction Change

of Maturity Instruction |

| |

|

|

| |

| Q: |

Can I place any Time Deposit Maturity

Instruction before the maturity date? |

| A: |

Yes. You can place Time Deposit Maturity Instruction one calendar day

before the date of maturity. Otherwise, the principal and accrued interest would be

automatically renewed for the same tenor. |

|

|

| |

| Q: |

Is there any minimum deposit amount requirement for placing the Time Deposit

through Internet / Telematic Banking Services? |

| A: |

Yes, the minimum deposit amount of Time Deposit is listed as follows:

| Currency |

Minimum Deposit

(in original currency) |

| Australian Dollar |

AUD 1,000 |

| New Zealand Dollar |

NZD 1,000 |

| Canadian Dollar |

CAD 1,000 |

| US Dollar |

USD 12,500 |

| Pound Sterling |

GBP 500 |

| Japanese Yen |

JPY 100,000 |

| Swiss Franc |

CHF 1,000 |

| Euro |

EUR 1,000 |

| Norwegian Kroner |

NOK 5,000 |

| Danish Kroner |

DKK 5,000 |

| Swedish Kroner |

SEK 5,000 |

| Singapore Dollar |

SGD 1,000 |

| Thailand Baht |

THB 20,000 |

| Hong Kong Dollar |

HKD 50,000 |

| Renminbi |

CNY 20,000 |

|

| |

|

|

| |

| 8. |

ePayment |

| Q: |

What is ePayment Service? |

| A: |

With ePayment Service, customer can make payment to more than 600 major merchants.

Payment to non-registered bills (except "Primary or Secondary Education", "Post-secondary or Specialised Education", "Government or Statutory Organisation" and "Public Utility" category) requires the use of Security Device.

The Bank will send a SMS notification to your pre-registered mobile phone number (if any) upon successful payment (except "Primary or Secondary Education", "Post-secondary or Specialised Education", "Government or Statutory Organisation" and "Public Utility" category).

You are advised to conduct regular review and delete unnecessary Bill Template via Internet Banking. A Bill Template will be deleted automatically if no payment was conducted for more than 12 months, or the merchant has ceased to be an ePayment merchant or terminated that bill type.

|

| |

|

|

| |

| Q: |

When will the merchant receive my bill payment? |

| A: |

Under normal circumstances, the payment will be proceeded

on the same business day, if the instruction is submitted before the cut-off time.

(Please refer to the Service Hour Table)

In case the instruction is submitted after cut-off time or during public holiday,

it will be proceeded on the next business day excluding Saturday. |

| |

|

|

| |

| Q: |

What is Electronic Bill Presentment & Payment Service? |

| A: |

With this service, customers can view eBill summary issued by merchants and make payment or donation via Internet Banking. Please note that payment or donation service require applying ePayment Service in advance. |

| |

|

|

| |

| 9. |

Remittance |

| Q: |

What are the advantages to use the remittance

of Business eBanking? |

| A: |

You can save transportation time and

manpower for submitting the paper application to us in

person. Besides, through the Registered Telegraphic Transfer (TT),

CHATS and HK-Macau Instant Remittance, you can place remittance instruction more efficiently.

Besides, you can submit your online pre-registered remittance applicable without filling in all the information again.

|

| |

|

|

| |

| Q: |

What kinds of remittance are

available through Business eBanking? |

| A: |

You can make Telegraphic Transfer, CHATS including

HKD, USD & EUR and HK-Macau Instant Remittance

via Business eBanking. |

| |

|

|

| |

| Q: |

When will the TT / CHATS instruction be executed? |

| A: |

Under normal circumstances, the TT /

CHATS instruction will be executed on same business day,

if the instruction is submitted before the cut-off time

(Please refer to the Service Hour Table).

In case the instruction is submitted after cut-off time

or during public holiday, instruction will be executed on the next

business day excluding Saturday. |

| |

|

|

| |

| Q: |

When will the beneficiary receive the fund? |

| A: |

For the TT / CHATS instruction submitted before the cut-off time (Please refer to the Service Hour Table),

it will be executed on the same business day subject to good fund received.

The beneficiary will receive the fund depending on the paying bank's and payee

bank's processing time. |

| |

|

|

| |

| Q: |

How can I know the TT / CHATS instruction

being executed and when can I get the receipt? |

| A: |

A message with transaction reference number will be posted at "Message Box" upon submission of the TT / CHATS instruction for notification. An official receipt will be mailed

directly to your correspondence address. |

| |

|

|

| |

| 10. |

e-Cheque service |

| Q: |

What is e-Cheque? |

| A: |

e-Cheque is an electronic counterpart of paper cheque where the cheque writing and deposit processes are totally online.

It is in PDF format and conforms to the standard accepted by Hong Kong Interbank Clearing Limited (HKICL). It has similar layout of a paper cheque and it is not negotiable nor transferable. |

| |

|

|

| |

| Q: |

What currencies are supported for e-Cheque? |

| A: |

HKD, USD and RMB. |

| |

|

|

| |

| Q: |

Is there any charge for using e-Cheque Services? |

| A: |

e-Cheque Issuance & e-Cheque Deposit Services are free of charge. However, service fees might be levied in other e-Cheque Services, e.g. stop payment of an issued e-Cheque.

The same fees are applicable to e-Cheque and Paper Cheque. For details, please refer to the current account section of OCBC Bank Service Fees. |

| |

|

|

| |

| Q: |

Who is eligible to use e-Cheque Service? |

| A: |

Customers who have opened a current account and registered for Internet Banking with Non-registered Third Party Account Transfer service can enjoy the e-Cheque Issuance service. Corporate customer is required to setup e-Cheque signing authority and transaction limits by submitting

Business eBanking Services - Company Profile Alteration Request Form to any of our branches. |

| |

|

|

| |

| Q: |

What is the e-Cheque Signing Authority? |

| A: |

e-Cheque Signing Authority allows company to assign Secondary Users into different e-Cheque Signing Groups. Through the preset transaction limit(s) for different combination(s) of e-Cheque Signing Groups,

the control of transaction limit can be achieved. Secondary User who was granted the e-Cheque signing authority should be classified into Group A, B or C. For e-Cheque issuance each time, it is required to select the e-Cheque Signing Group(s) and signer(s). |

| |

|

|

| |

| Q: |

What is the process for corporate customers to issue an e-Cheque? |

| A: |

The e-Cheque issuance process consists of e-Cheque creation and signing. To create an e-Cheque, a user needs to fill in the cheque details,

and select the e-Cheque Signing Group(s) and signer(s) to submit for approval. An e-Cheque can be signed by ONE or TWO approvers. Then, the corresponding signer(s) can approve or reject the submitted e-Cheque. The e-Cheque will be issued after all required signers have finished signing. |

| |

|

|

| |

| Q: |

Can I edit the e-Cheque which has been submitted for approval? |

| A: |

No, but you may delete the submitted e-Cheque and create a new one to submit for approval if needed. |

| |

|

|

| |

| Q: |

Can I edit the e-Cheque which has been rejected by approver(signer)? |

| A: |

No. but you may create a new e-Cheque to submit for approval if needed. |

| |

|

|

| |

| Q: |

Can signer approve the pending e-Cheque if the signer has changed the e-Cheque Signing Group? |

| A: |

No, the pending e-Cheque cannot be signed if the signer no longer belongs to the e-Cheque Signing Group as defined in the e-Cheque submitted. |

| |

|

|

| |

| Q: |

Can I still be able to use paper cheque? |

| A: |

Yes. |

| |

|

|

| |

| Q: |

What is the validity period of an e-Cheque? |

| A: |

The e-Cheque will be valid for 6 months from the Cheque Date. |

| |

|

|

| |

| Q: |

Can I issue a back-dated e-Cheque? |

| A: |

No, back-dated e-Cheque is not allowed. |

| |

|

|

| |

| Q: |

Can I issue a post-dated e-Cheque? |

| A: |

Yes, you can issue a post-dated e-Cheque up to 3 months from the issue date. |

| |

|

|

| |

| Q: |

Can I issue bearer cheque or cash cheque for e-Cheque? |

| A: |

No, an e-Cheque must be addressed to a payee and deposited to the payee's bank account. Besides, it cannot be exchanged for cash over the bank counter. |

| |

|

|

| |

| Q: |

Can I edit the details of e-Cheque after submitting to issue? |

| A: |

No amendment is allowed after e-Cheque is submitted for issuance. |

| |

|

|

| |

| Q: |

How can I download the e-Cheque file again after issuance? |

| A: |

You can go to e-Cheque Issuance History to search and download the issued e-Cheque file. |

| |

|

|

| |

| Q: |

Can I stop an issued e-Cheque? |

| A: |

You can use the Stop Cheque function under Cheque Services on Internet Banking by inputting the e-Cheque number. A handling charge will be levied which is the same as for paper cheque.

For details, please refer to the current account section of OCBC Bank Service Fees. |

| |

|

|

| |

| Q: |

How to deposit e-Cheque to OCBC Bank? |

| A: |

You can deposit e-Cheque to OCBC Bank accounts (including bank accounts and credit cards)

through the e-Cheque Drop Box service provided by Hong Kong Interbank Clearing Limited (http://www.echeque.hkicl.com.hk). |

| |

|

|

| |

| Q: |

How can I check the details & status of the issued e-Cheque? |

| A: |

You may check the status of the issued e-Cheque in the past 6 months via e-Cheque Issuance History in Internet Banking. |

| |

|

|

| |

| Q: |

Is there a maximum cheque amount of e-Cheque issuance? |

| A: |

Yes, the amount is subject to your daily transfer limit of non-registered accounts in Internet Banking, while the limit is shared by all kinds of Non-Registered

Account Fund Transfer, including OCBC Bank and Other Bank Account Transfer, Telegraphic Transfer, CHATS etc. For details, please refer to Fund Transfer. |

| |

|

|

| |

| Q: |

Do I need to install any software in order to view e-Cheque PDF file? |

| A: |

Customers are required to install Acrobat Reader and Traditional Chinese Font Pack on personal computers to view PDF file of e-Cheque. |

| |

|

|

| |

| 11. |

Cheque Services |

| Q: |

How long can I enquire my issued cheque

status? |

| A: |

There is no time restriction to enquire

your issued cheque. |

| |

|

|

| |

| Q: |

Is there any handling charge for stop cheque payment? |

| A: |

Yes, a handling charge for stop cheque payment will be levied. For

details, please refer to the current account section

of our OCBC Bank Service Fees. |

| |

|

|

| |

| 12. |

Payroll |

| Q: |

Do other local bank accounts can be registered as beneficiary

account for payroll services? |

| A: |

Yes. For payroll service, you are required to pre-register the beneficiary

account by submitting a "Business eBanking Services - Beneficiary Registration / Alteration Request Form" to any of

our branches.

|

| |

|

|

| |

| Q: |

What type of accounts

can be accepted as a beneficiary account? |

| A: |

Only HKD Current, Passbook Savings and Statements Savings accounts are accepted. |

| |

|

|

| |

| |

| Q: |

When will the beneficiary receive the fund

if I submit the payroll instruction before the cut-off

time? |

| A: |

If the beneficiary account is OCBC Bank

Bank account, the beneficiary will receive the fund in the

next business day. Otherwise, it will generally take one business

day depending on the processing time of the receiving banks. |

| |

|

|

| |

| 13. |

Upload Payroll Instruction Service |

| Q: |

What is Upload Payroll Instruction Service? |

| A: |

Customer can conduct payroll transactions by uploading a specific payment

instruction file. Application of eCertificate Service is required but pre-registration of

beneficiary account is not necessary for this service. |

| |

|

|

| Q: |

Which file type does this service support? |

| A: |

Customer can upload the payment instruction file in

the form of CSV or the file generated from Magnetic Autopay System

software (MAS). The file format of generating a CSV file could be

referred to

Business eBanking Services - User Guide. |

| |

|

|

| Q: |

When will the beneficiary receive the fund if I

submit the payroll instruction before the cut-off time? |

| A: |

If the beneficiary account is OCBC Bank account,

the beneficiary will receive the fund on the same day. Otherwise, it will

generally take one business day depending on the processing time of

the receiving banks. |

| |

|

|

| |

| 14. |

Upload Batch Payment Instruction Service |

| Q: |

What is Upload Batch Payment Instruction Service? |

| A: |

The operation of "Upload Batch Payment Instruction Service" and

"Upload Payroll Instruction Service" are mostly the same except the description on

the monthly statement. If the beneficiary account is OCBC Bank account,

the transaction description on the monthly statement will be indicated as

"TRANSFER CREDIT" instead of "PAYROLL DEPOSIT". |

| |

|

|

| |

| 15. |

Trade Services |

| Q: |

What are the advantages to use the trade

services of Business eBanking? |

| A: |

By using the trade services of Business eBanking,

you can save transportation time and manpower for submitting the paper

application so as to speed up the processing time. |

| |

|

|

| |

| Q: |

What kind of trade services are available through Business eBanking? |

| A: |

Credit Limit Utilization Enquiry

Credit Limit Utilization Enquiry

Inward

Bills Transaction Enquiry Inward

Bills Transaction Enquiry

Outward

Bills Transaction Enquiry Outward

Bills Transaction Enquiry

Letter

of Credit (L/C) Application Letter

of Credit (L/C) Application

Letter

of Credit (L/C) Amendment Application Letter

of Credit (L/C) Amendment Application

|

| |

|

|

| |

| Q: |

How can I know the L/C application has

been rejected? |

| A: |

While the L/C application was successfully

submitted, an acknowledgement number will be generated

for your reference. In case of rejection, our staff will

contact you directly and also a message will be posted

at "Message Box" for notification. |

| |

|

|

| |

| Q: |

Can I save some frequently used L/C application and L/C amendment

for future use? |

| A: |

You can create L/C application and L/C

amendment templates through "new template" function

at L/C Application Template. It facilitates you to make

new L/C application(s) and L/C amendment effectively. |

| |

|

|

| |

| Q: |

Can I save some frequently used terms

for future use? |

| A: |

You can save some frequently used terms

on Clipboard(s) at L/C BENEFICIARY,

DOCUMENTS REQUIRED, GOODS DESCRIPTION and OTHER TERMS

AND CONDITIONS to facilitate making new L/C application.

|

| |

|

|

| |

| 16. |

Requisition |

| Q: |

How many cheque books I can request at

the same application? |

| A: |

You can request up to 5 cheque books per application. |

| |

|

|

| |

| Q: |

What types of cheque book can I request for? |

| A: |

A bearer type cheque book will be given for HKD current account.

An order type cheque book will be provided for USD current account. |

| |

|

|

| |

| 17. |

Other Services |

| Q: |

Can I change my User ID and PIN? |

| A: |

You may change your User ID or PIN online by selecting

"Change of User ID" or "Change of PIN" under the "Other Services" section.

|

| |

|

|

| |

| Q: |

For the first time login, do I need to change the PIN? |

| A: |

For the first time login, you are required to change your

User ID and PIN.

|

| |

|

|

| |

| Q: |

What can I do if I forget my User ID

/ PIN? |

| A: |

You should re-issue your User ID and PIN by submitting

the Business eBanking - User Alteration Request Form

to any of

our branches. |

| |

|

|

| |

| Q: |

What will happen if I enter an incorrect PIN? |

| A: |

Your service will be suspended if

you enter incorrect PIN for 5

times consecutively. You are required to submit the

Business eBanking - User Alteration Request Form to reissue

your PIN. |

| |

|

|

| |

| Q: |

How can I re-activate the disabled

account service? |

| A: |

You should re-issue your User ID and PIN by submitting

the Business eBanking - User Alteration Request Form

to any of

our branches.

|

| |

|

|

| |

| Q: |

Can I re-register after suspending the use of Business eBanking? |

| A: |

Yes, you can choose to temporarily suspend

your Business eBanking by submitting a

Business eBanking - User Alteration Request Form to any of our

branches. You may also resume your services thereafter by submitting a

Business eBanking - User Alteration Request Form.

A new set of User ID / Telematic code and PIN will be reissued. |

| |

|

|

| |

| Q: |

What is the service fees for Business eBanking? |

| A: |

Business eBanking is a free of charge service. However,

please note that service fees are applicable to designated services such

as remittance services and stop cheque payment etc. For details, please refer to

OCBC Bank Service Fees. |

| |

|

|

| |

| 18. |

Investment |

| Q: |

What are the services provided by "Investment" services? |

| A: |

"Investment" services provide you with various online investment services, including:

Portfolio enquiry of your Securities Account and Investment Account

Portfolio enquiry of your Securities Account and Investment Account

Securities trading includes buy / sell order placement, order status enquiry, order reduction and order cancellation

Securities trading includes buy / sell order placement, order status enquiry, order reduction and order cancellation

Real time and delayed stock price enquiry

Real time and delayed stock price enquiry

Securities transaction history enquiry up to last 60 days

Securities transaction history enquiry up to last 60 days

|

| |

|

|

| |

| Q: |

What type of investment product can I trade through "Securities" services? |

| A: |

All securities and warrants listed on the Hong Kong Exchange and Clearing Limited can be traded in "Securities" services. |

| |

|

|

| |

| Q: |

What should I pay attention to before I place a securities trading order? |

| A: |

Prior to placing a buy securities trading order, there must be

sufficient funds in your settlement account to cover the trading amount including commission

and other charges. The amount will be withheld upon broker's acknowledgment of your buy

order. An extra amount of CNY 2.00 will be held for each CNY denominated stock buy order

for the purpose of settling the shortfall of various trading related fees

(including stamp duty, transaction levy, Financial Reporting Council transaction levy, investor compensation levy (currently exempted),

trading fee, trading tariff, etc.) payable by you in Hong Kong dollars after converting

such by using the relevant exchange rate determined by the Hong Kong Monetary Authority,

subject to the Bank's absolute discretion.

Likewise, prior to placing a sell order, there must be sufficient available quantity

for sale in your securities account. The securities sold will be withheld upon

acknowledgment of your sell order. |

| |

|

|

| |

| Q: |

How can I check the available balance of my settlement account? |

| A: |

You can check the available balance of your settlement account through

clicking "Settlement A/C Balance" button during you place an order. Alternatively,

you can check the balance via "Account Services". |

| |

|

|

| |

| Q: |

How can I check the net quantity for trade of the securities? |

| A: |

You can check the net quantity for trade of the securities by clicking

"Stock Balance" button. Alternatively, you can check the balance via "Account

Services". |

| |

|

|

| |

| Q: |

How can I inquire the stock price for securities order placement? |

| A: |

You can check the stock price through clicking "Stock Price Enquiry" button when you place an order. Besides, you can inquire more details of stock price by using "Stock Price Enquiry" service. |

| |

|

|

| |

| Q: |

Can I sell shares bought on the same day? |

| A: |

Yes. Once your purchase order has been executed,

you can sell the shares thereafter. |

| |

|

|

| |

| Q: |

Can I buy shares using the sales

proceeds from the stocks I sold on the same day? |

| A: |

Yes. Once your sell order has been executed,

the funds can be used immediately to buy shares. |

| |

|

|

| |

| Q: |

How can I be sure that the securities order has successfully

reached OCBC Bank? |

| A: |

You will receive an unique order number for each individual order

you placed. However, it only represents that the order is acknowledged by the Bank.

You are recommended to check the latest status of the order through "Order Status"

services. |

| |

|

|

| |

| Q: |

How long does the securities order last? |

| A: |

The securities trading order will stay valid until the end of

the trading day unless a cancellation is received. |

| |

|

|

| |

| Q: |

How do I know the transaction status of my securities trading order? |

| A: |

Through "Order Status" service, you can inquire the latest order status of your all securities trading order placed on current trading day, last trading day (T-1) and last 2 trading days (T-2). Further, you can inquire the completed securities trading order up to last 60 days by using "Transaction History" service. |

| |

|

|

| |

| Q: |

What is the settlement procedure for online securities trading? |

| A: |

Settlement arising from online securities trading will be debited from / credited to your

settlement account on settlement date (T+2). Your securities will be safe kept under the

nominee account of OCBC Bank. This is to ensure that all the dividend and bonus shares

are credited to your custody account. |

| |

|

|

| |

| Q: |

Can I place order by email instead of the online trading system? |

| A: |

The Bank do not accept securities order through email. Indeed, email is not a secure communication method. |

| |

|

|

| |

| Q: |

What is Enhanced Limit Order? |

| A: |

Enhanced Limit Order is an order type that allows matching in up to 10 price queues, where the price of the trade generated is at or better than the limit price. The unfilled orders after matching will be converted to limit orders at the input limit price. |

| |

|

|

| |

| Q: |

How many free real-time stock quotes offered? |

| A: |

You are entitled to 300 times free real-time stock quote per month.

For OCBC Premier Banking Customers, you will be offered 2,000 times free real-time stock quote per month. You can also apply "Additional Stock Quote" Service for additional usage on top of the free quotes offered. |

| |

|

|

| |

| 19. |

Foreign Exchange Margin Trading |

| Q: |

What are the services provided by "FX Margin Trading" services? |

| A: |

"FX Margin Trading" services provide you with various online services, including:

Margin Trading Account Balance Enquiry

Margin Trading Account Balance Enquiry

Margin Trading Account Transaction History Enquiry

Margin Trading Account Transaction History Enquiry

Outstanding / Setoff transaction Enquiry

Outstanding / Setoff transaction Enquiry

Margin Deposit / Withdrawal

Margin Deposit / Withdrawal

|

| |

|

|

| |

| Q: |

What is "Currency Transfer"? |

| A: |

"Currency Transfer" allows you to transfer fund from one

currency to another currency under same Margin Trading account. It facilitates you to

settle the outstanding interest payable amount for the setoff transaction. The currency

transfer should be made in either HKD or USD. |

| |

|

|

| |

| 20. |

Administrator Management |

| Q: |

What functions do "Company Administration

and Enquiry" provide? |

| A: |

|

Company Profile Enquiry - Enquire

company's profile details |

|

Approval Matrix Enquiry - Enquire

the company's transaction approval limit setting by the different

combination of Approval Groups (i.e. A, B & C) |

|

Account List Maintenance - Disable

the account permission |

|

Banking Service Maintenance - Suspend

the service of the company and lower the transaction

daily limit |

|

Instruction Enquiry - Enquire the registered

transfer instruction |

|

| |

|

|

| |

| Q: |

How can I re-activate the disabled account

service and reset the reduced daily transaction limit? |

| A: |

You should submit a Business eBanking - Company Profile Alteration Request Form to any of our branches. Normally, it

will take approximate two business days for processing. |

| |

|

|

| |

| Q: |

How can PU know he/she has to approve

the new SU? |

| A: |

PU should check the "Pending

For Approval Request " by clicking "User

Administration Pending List" to approve the new SU. |

| |

|

|

| |

| Q: |

What should the PU does before he/she approves

the authorization of the new SU? |

| A: |

PU should verify the profile of new

SU by clicking the hyperlink "Please

click here to enquire and update the user profile".

Then, PU can check the user details, such as NACT

list, Account List & Service List through

the hyperlink of the right corner respectively. After

that, PU should back to "User

Administration Pending List" and approve the SU. |

| |

|

|

| |

| Q: |

What can I enquire from the "User

Activities History"? |

| A: |

You can enquire the instructions made

by the designated user. |

| |

|

|

| |

| Q: |

How can PU enquire his/her administration

record? |

| A: |

PU can enquire the administration record

of the company or SU by clicking "Administration

History". |

| |

|

|

| |

| Q: |

How long the record can be enquired?

|

| A: |

You can enquire the administration record up to last 30 calendar days. |

| |

|

|

| |

| 21. |

Security Device |

| I) |

Introduction |

| Q: |

What is a Security Device? |

| A: |

A Security Device is a portable electronic device used to generate one-time Security Code. Security Code are required to authenticate designated e-Banking transactions. Each business e-Banking account is linked to one Security Device only.

OCBC Bank Business Security Device OCBC Bank Business Security Device

|

| |

|

|

| |

| Q: |

What is a Security Code? |

| A: |

A Security Code is the random 6-digit one-time password generated by the Security Device. It is used to verify a user's online identity and is only valid within a short time interval. |

| |

|

|

| |

| Q: |

What is a Serial Number? |

| A: |

A Serial Number is the unique number printed on the back of the Security Device. The number consists of 10 digits and is in form of XX-XXXXXXX-X (e.g. 01-2345678-9). |

| |

The Serial Number is required to activate Security Device in order to link a unique Security Device to your Business e-Banking account. Thus, it is the only Security Device to access your Business e-Banking services. |

| |

|

|

| |

| Q: |

Why do I need the Security Device? |

| A: |

To enhance online security, you are advised to apply for a Security Device as it is a reliable tool to verify your identity and authenticate designated e-Banking transactions. With a Security Device, you can enjoy full access to our e-Banking services. |

| |

|

|

| |

| Q: |

When do I need the Security Device? |

| A: |

Below are the designated e-Banking transactions required the Security Device:

- Non-registered Third Party Account Fund Transfer

- Non-registered Other Bank Account Transfer

- Non-registered CHATS

- Non-registered TT

- Non-registered HK-Macau Instant Remittance

- ePayment (EPSCO bill payment to non-registered bills)

- EBPP bill payment to non-registered bills and donation Financial

- e-Cheque Issuance

- Approval required transactions (For approver)

|

| |

|

|

| |

| Q: |

How can I apply for a Security Device? |

| A: |

You can apply for a Security Device by visiting any one of our branches. |

| |

|

|

| |

| Q: |

How many Security Device do I need if I have registered for more than one Business e-Banking profile?

|

| A: |

Each Secondary Users should be paired up with one Security Device. |

| |

|

|

| |

| Q: |

Do I need to pay for the Security Device?

|

| A: |

The Security Device is free of charge for all first-time applications. However, replacement due to lost or damage will be subject to a $100 fee. |

| |

|

|

| |

| II) |

Activation |

| Q: |

What should I do after I have received the Security Device?

|

| A: |

You should activate the device as soon as possible. |

| |

|

|

| Q: |

How to activate a Security Device? |

| A: |

Please follow the below steps to activate your Security Device:

(1)Login to Business e-Banking

(2)Go to "Other Services" -> "Activate Security Device"

(3)Input Serial Number and Security Code, then Click "Submit"

(4)A Security Key No. will be sent to your registered mobile phone number. Enter the Security Key No. and click "Confirm"

(5)You will see the message "Your Instruction was executed" and it means your Security Device is activated. You can use the device to perform transactions immediately.

|

| |

|

|

| |

| III) |

Using e-Banking with Security Device |

| Q: |

What transaction specific information do I need to enter into my Security Device when I am performing designated e-Banking transactions?

|

| A: |

Please follow the on-screen instructions on the e-Banking pages to input the correct information into your Security Device and generate the required Security Code. |

| |

Examples of such instructions are shown below:

| Beneficiary account number / Bill account number / Debtor reference |

Instructions |

Example |

Input |

| With 8 or more digits |

Enter the last 8 digits only. |

123-4-567890

01234567 |

34567890

01234567 |

| With 4-7 digits |

Enter all digits. |

123456 |

123456 |

| With 0-3 digits |

Verification is not applicable at Business e-Banking. Please perform your transaction at any of our branches. |

123

AB12CD3E |

N/A |

| Comprising numeric and non-numeric characters |

Skip all non-numeric characters. Enter the digits into the Security Device. |

00123A45B678E9

A12233 |

23456789

12233 |

|

| |

|

|

| |

| Q: |

If I input wrong information to the Security Device, how can I change it? |

| A: |

You can press button to delete your last entry.

Press and hold button to delete your last entry.

Press and hold button to clear all your inputs. button to clear all your inputs.

|

| |

|

|

| |

| Q: |

Why the Security Code I entered when performing designated e-Banking transactions is not accepted?

|

| A: |

Your entered Security Code may not be accepted due to one of the following reasons:

1.You may have entered an invalid Security Code (including the entered Security Code not equal to the one displayed on

your Security Device or entered incorrect transaction specific information into your Security Device).

2.Each Security Code is only valid for a short time interval. The time permitted for entry of the Security Code has expired.

Please follow the on-screen instructions and repeat the process to generate a valid Security Code. If the Security Code is still not accepted, please contact our Customer Service Hotline at 3199 9188.

|

| |

|

|

| |

| Q: |

What should I do if I have incorrectly entered the Security Code for several times? |

| A: |

If you have incorrectly entered the Security Code for several times consecutively, your Security Device will be suspended and you are not able to perform any designated e-Banking transactions.

Please contact our Customer Service Hotline at 3199 9188 for reactivation. |

| |

|

|

| |

| IV) |

Troubleshooting |

| Q: |

What should I do if my Security Device is lost / stolen?

|

| A: |

Please contact our Customer Service Hotline at 3199 9188 or visit any

of our branches to suspend your Security Device and request for replacement immediately. |

| |

|

|

| |

| Q: |

What should I do if my Security Device is broken / running out of battery? |

| A: |

The battery in your device cannot be replaced. Please contact our Customer Service Hotline at

3199 9188 or visit any of our branches and request for replacement.

|

| |

|

|

| |

| Q: |

Do the buttons " " and " " and "

" indicate any special functions? " indicate any special functions?

|

| A: |

There are no particular usages associated with these buttons at this moment.

|

| |

|

|

| |

| 22. |

eCertificate Service |

| Q: |

What is eCertificate Service? |

| A: |

eCertificate Service is an authentication scheme that increases online security

for verifying a user's identity. Applicant will be issued a USB Security Token and

its eCertificate Password for conducting designated transactions / instructions.

|

| |

|

|

| Q: |

Which type of transactions are required to apply for eCertificate Service? |

| A: |

Customer can apply eCertificate Service for each designated user in order to

conduct the following transactions:

Upload Payroll Instruction Service

Upload Payroll Instruction Service

Upload Batch Payment Instruction Service

Upload Batch Payment Instruction Service

|

| |

|

|

| Q: |

How to use the USB Security Token? |

| A: |

Please plug in the USB Security Token into a computer and follow the screen

instruction to install the eCertificate software first. You are advised to change the

initial eCertificate Password on the first log in. Details could be referred to

Business eBanking Services - User Guide

. |

| |

|

|

| Q: |

How to change my eCertificate Password? |

| A: |

You may use the software appended in the USB Security Token to change your

eCertificate Password. Firstly, plug in the USB Security Token into a computer. In Start

Menu, open All Programs > EnterSafe > ePass3003 Token Manager. Select 'Change

User PIN' and enter the Old and New User PIN, then click OK. |

| |

|

|

| Q: |

Is eCertificate Password secure? |

| A: |

eCertificate Password must be 8 characters with combination of letters and

numbers. The USB Security Token will be suspended after 6 consecutive invalid attempt.

|

| |

|

|

| |

| 23. |

System Requirement |

| Q: |

What is the minimum system requirement

for the use of Business eBanking? |

| A: |

Hardware requirements:

A Personal Computer (PC) with

Intel Pentium 4 CPU or higher

Intel Pentium 4 CPU or higher

512 MB or more main memory (RAM)

512 MB or more main memory (RAM)

56kbps modem or broadband connection to Internet but

broadband is recommended

56kbps modem or broadband connection to Internet but

broadband is recommended

SVGA Monitor

SVGA Monitor

Display:

800 x 600 pixels, 256 colour

800 x 600 pixels, 256 colour

Software Requirements:

Windows or Mac OS X operating system

Windows or Mac OS X operating system

Internet Explorer 11, Mozilla Firefox 3.8, Safari 8, Chrome 58 or higher, it must support TLS 1.2 encryption or above with Java Script, Cookies enabled

Internet Explorer 11, Mozilla Firefox 3.8, Safari 8, Chrome 58 or higher, it must support TLS 1.2 encryption or above with Java Script, Cookies enabled

Java Runtime Environment:

Java Version 1.8.0_66 or above

Java Version 1.8.0_66 or above

|

| |

|

|

| |

| 24. |

Security |

| Q: |

Is it secure to perform transactions

through Business eBanking - Internet Banking Services? |

| A: |

Our Internet Banking Services provide the following security

measures to ensure your banking information and account

details are secure.

| a. |

Select your User ID and PIN once

you login to Internet Banking Services for the

first time, you are required to select a unique

User ID and PIN. You must enter correct User ID

and PIN, every time you enter to OCBC Bank Business

eBanking. |

| b. |

Internet Banking Services will

be automatically terminated if there is no activity

for 10 minutes in order to protect against unauthorized access. |

| c. |

Secure Socket Layer (SSL) with

128-bit encryption is employed to ensure confidentiality.

All data and information transmitted between you and our

Internet Banking Service are encrypted by using 128-bit encryption. |

|

| |

|

|

| |

| Q: |

What should I do to reinforce security? |

| A: |

Despite the enormous efforts taken by us, you are playing

an important role in ensuring the system security. The

following security tips are highly recommended:

| a. |

Install anti-virus and/ or anti-spyware

software in your personal computer and update the software

regularly to ensure you have the latest protection. |

| b. |

Install a personal firewall on

your personal computer to help your prevent unauthorized

access and update the firewall regularly to ensure

you are covered with the latest protection. For

details, please contact your software vendor. |

| c. |

Install security updates and patches

to your personal computer or browser when they are

made available. They are designed to provide you

with protection from known possible security problems.

|

| d. |

Do not conduct Internet Banking

Services transaction using the personal computers that are available

for public access (e.g. Cyber Cafe). |

| e. |

Do not open Email attachment from

unknown, suspicious or unreliable sources. |

| f. |

Do not install unlicensed software,

which may contain bugs and viruses. |

| g. |

To prevent installation of spyware,

do not download any software with unknown sources,

e.g. free-ware, music, or screen savers, etc. |

| h. |

Do not leave your relevant devices

(e.g. personal computers or mobile phone) unattended

in the middle of a session. |

| i. |

Do not browse other website by

opening a new session, while you are using Internet

Banking Services. |

| j. |

Verify the security certificate of our website by clicking the 'Lock' icon at the browser's address bar. |

| k. |

Limit the access to your personal

computer only to reliable persons. |

| l. |

Regularly check your account balances

and statements. If any suspicious account activities

were found, please contact us via our Customer Services Hotline at

3199 9188. |

| m. |

Always logout after you have completed

your Internet Banking Services transaction. |

| n. |

Select a new User ID and change

the initial PIN immediately while login to Internet

Banking Services for the first time.

|

| o. |

Keep your User ID and PIN well to prevent them from being stolen.

|

| p. |

To protect your interest, we suggest you destroying the PIN documents after memorizing the PIN.

|

| q. |

Do not keep any written record of the User ID and PIN near the computer.

|

| r. |

Do not disclose your User ID and

PIN to anyone else including our staff. |

| s. |

Do not write down or record your

PIN without disguising it. |

| t. |

Do not allow others to use your User ID and PIN. |

| u. |

Do not use easy accessible number

or data such as your birthday, ID or personal telephone

number as your User ID or PIN. |

| v. |

Do not use the same set of User

ID or PIN from other Internet site. |

| w. |

Change your PIN and check the security advice through our website (http://www.ocbc.com.hk) from time to time. |

| x. |

Change your User ID or PIN periodically.

For example every 30 or 60 days. |

| y. |

Always contact us immediately if you lose your User ID or PIN, or suspect your Internet Banking account is stolen. |

|

| |

|

|

| |

| Q: |

Do I need to inform the Bank if I have changed my contact phone number and/or correspondence address? |

| A: |

Yes, to ensure the Bank can contact you in an efficient manner, please inform us your latest contact phone number and/or correspondence address by submitting a

Change of Address Form

to any of our branch. |

| |

|

|

| |

| Q: |

Can I exit Internet Banking

Services by simply double clicking the button at the top

right hand corner of the browser? |

| A: |

You should click the "Logout" button at the

right-hand corner to exit Internet Banking Services. This will

ensure that your account has been properly logged off. If you exit

the service by simply clicking the button at top right hand corner

of the browser, your Internet Banking Services will still be available until

exceeding valid time. |

| |

|

|

| |

| Q: |

What should I do to avoid

storing my PIN or Password when using a browser? |

| A: |

IE 6.0 or above:

i. Select "Tools" from Menu bar

ii. Pick "Internet Options" and choose "Content"

iii. Under "Personal Information", click on "AutoComplete"

iv. Uncheck "User names and passwords on forms"

v. Click on "Clear Passwords"

vi. Click on "OK" to save the changes

Mozilla Firefox 3.6.3 or above:

i. Select "Tools" from Menu bar

ii. Pick "Options" and choose "Security"

iii. Uncheck "Remember passwords for sites"

iv. Click on "OK" to save the changes

|

| |

|

|

| |

| Q: |

How do I know I have accessed to the

web page of Business eBanking - Internet Banking Services

that belongs to OCBC Bank? |

| A: |

You may verify the security certificate of our website by clicking the 'Lock' icon at the browser's address bar, which a server certificate issued by VeriSign will appear and the details validity of the certificate will be shown. |

| |

|

|

| |

| Q: |

What should I do if I want to enable

the TLS feature? |

| A: |

Steps to enable TLS for Microsoft Internet Explorer:

i. Select [Tools] from the Menu bar

ii. Select [Internet Options]

iii. Select [Advanced] Tab

iv. Go to [Security] Section and click [Use TLS 1.2] checkbox

v. Click [OK] to exit the dialog box

Steps to enable TLS for Mozilla Firefox:

i. Select [Tools] from the Menu bar

ii. Select [Options]

iii. Select [Advanced]

iv. Go to [Encryption] Tab and click [Use TLS 1.2] checkbox

v. Click [OK] to exit the dialog box

|

| |

|

|

| |

| Q: |

How should I know my personal computer

has already installed with Java Runtime Environment? |

| A: |

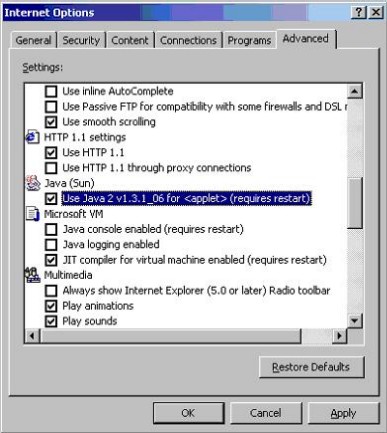

Steps to check/enable Java Runtime Environment for Windows Microsoft Internet Explorer:

- Open Internet Explorer

- Select [Tools] from the Menu bar

- Select [Internet Options]

- Select [Advanced] Tab

- Go to Java (Sun)

- Click "Use Java" (Java Runtime Environment Version must be 1.8.0_66 or above)

- Click [OK] to exit the dialog box

- Restart Internet Explorer

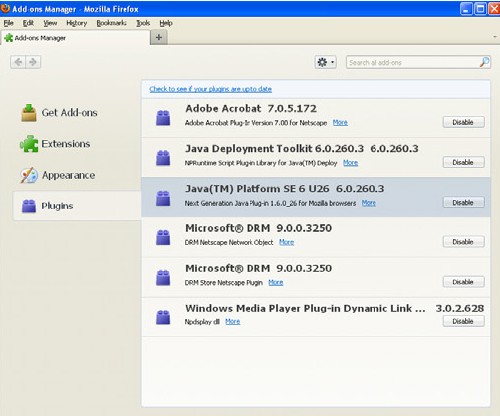

Steps to check/enable Java Runtime Environment for Windows Mozilla Firefox:

- Open Mozilla Firefox

- Select [Tools] from the Menu bar

- Select [Options]

- Select [General]

- Click "Manage Add-ons"

- Go to [Plugins] tab and enable "Java" (Java Runtime Environment Version must be 1.8.0_66 or above)

- Restart Mozilla Firefox

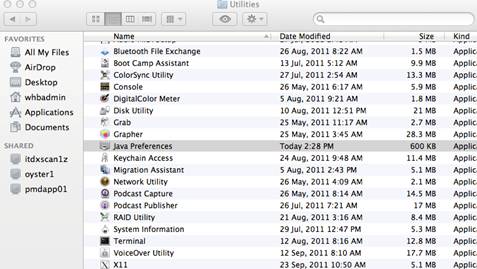

Steps to check/enable Java Runtime Environment for Mac OS X Safari:

- Open [Finder]

- Select [Applications] from the Menu bar

- Select [Utilities]

- Select [Java Preferences] to install and check the version (Java Runtime Environment Version must be 1.8.0_66 or above)

- After installed, Open Safari

- Select [Preferences]

- Click [Securities]

- Click [Enable plug-ins] and [Enable Java]

- Restart Safari

|