Premium Financing & Policy Financing

Experience professional and personal financial planning services

Key Facts Statement

Insurance Financing Service – Enhance your financial flexibility with an added layer of protection

In the realm of wealth management, OCBC Bank (Hong Kong) Limited always strive to go the extra mile. Our insurance financing service is designed to offer Premium Financing and Policy Financing options for eligible customers1 and selected life insurance products2.

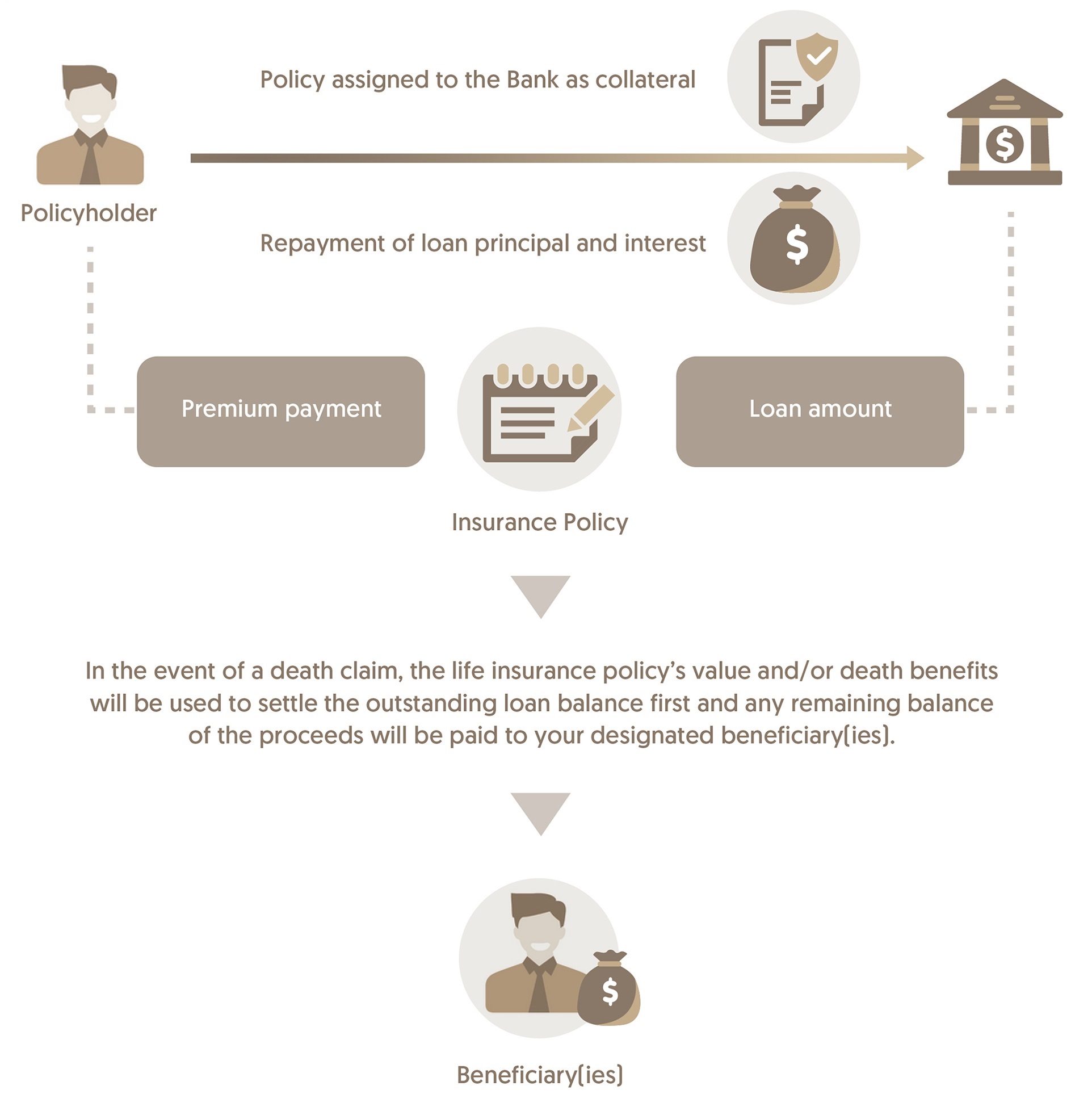

Premium Financing allows you to finance a portion of your insurance policy premium, using the life insurance policy itself as collateral.

Financing is also secured by the life insurance policy. It can provide flexibility on the financial situation to obtain extra cash flow for personal use after purchasing the life insurance policy.

Note: Premium Financing is a credit facility and involves borrowing. This incurs interest payments at a variable rate and may come with the risk of losing your rights under the insurance policy among other potential risks.

The above sample diagram is for reference only.

Why Premium Financing?

Life insurance policies that provide value appreciation and cash value usually come with dividends and a surrender value. These policies hold intrinsic value and can be used as collateral. When market interest rates for bank loans are relatively low, these policies become appealing to individuals who can manage the loan interest. Consequently, these insurance policies are utilized as security in Premium Financing arrangements.

Unlock your cash flow for smarter financial management

By leveraging Premium Financing, you gain enhanced financial flexibility when paying your premiums. Instead of liquidating your assets to cover the entire premium amount, you can use Premium Financing to fund a portion of the payments. This approach allows you to preserve your assets and allocate your funds towards seizing other opportunities, making investments, or covering various expenses.

1 "Eligible customers" refers to those who meet the requirements set by OCBC Bank (Hong Kong) Limited (the “Bank”), including an assessment of their credit history, financial status, background, and other relevant factors.

2 "Selected life insurance products" refers to specific insurance products eligible for Premium/Policy Financing by the Bank.

Important notes on Premium Financing

Variable interest rates

The interest rate on a Premium Financing loan is calculated based on HIBOR/ Cost of Funds (“COF”) plus a margin. HIBOR/COF will fluctuate and may change from time to time according to market interest rates, and it is not capped. An increase in HIBOR/COF implies you will be required to pay more interest. The interest you pay may even exceed the return of the life insurance policy, leading to potential losses.

HIBOR is the Hong Kong Dollar Interest Settlement Rates as published by The Hong Kong Association of Banks (www.hkab.org.hk). Please refer to our HIBOR Rate.

COF means, in respect of any currency or product, the interest rate as conclusively determined by the Bank from time to time at its sole and absolute discretion as the Bank’s cost of funds for that currency or specific product, and the Bank’s determination and discretion shall be conclusive and binding on you.

We also offer a Prime Lending Rate for selected policies. You can refer to our Prime Lending Rate.

Should you have any queries about the interest rate, please contact your relationship manager or visit any of our branches for more information.

Illustration:

Mr. Chan, aged 55 (aged of next birthday), non-smoker:

Purchase a life insurance policy with total premium payment at USD 1,000,000 using personal fund

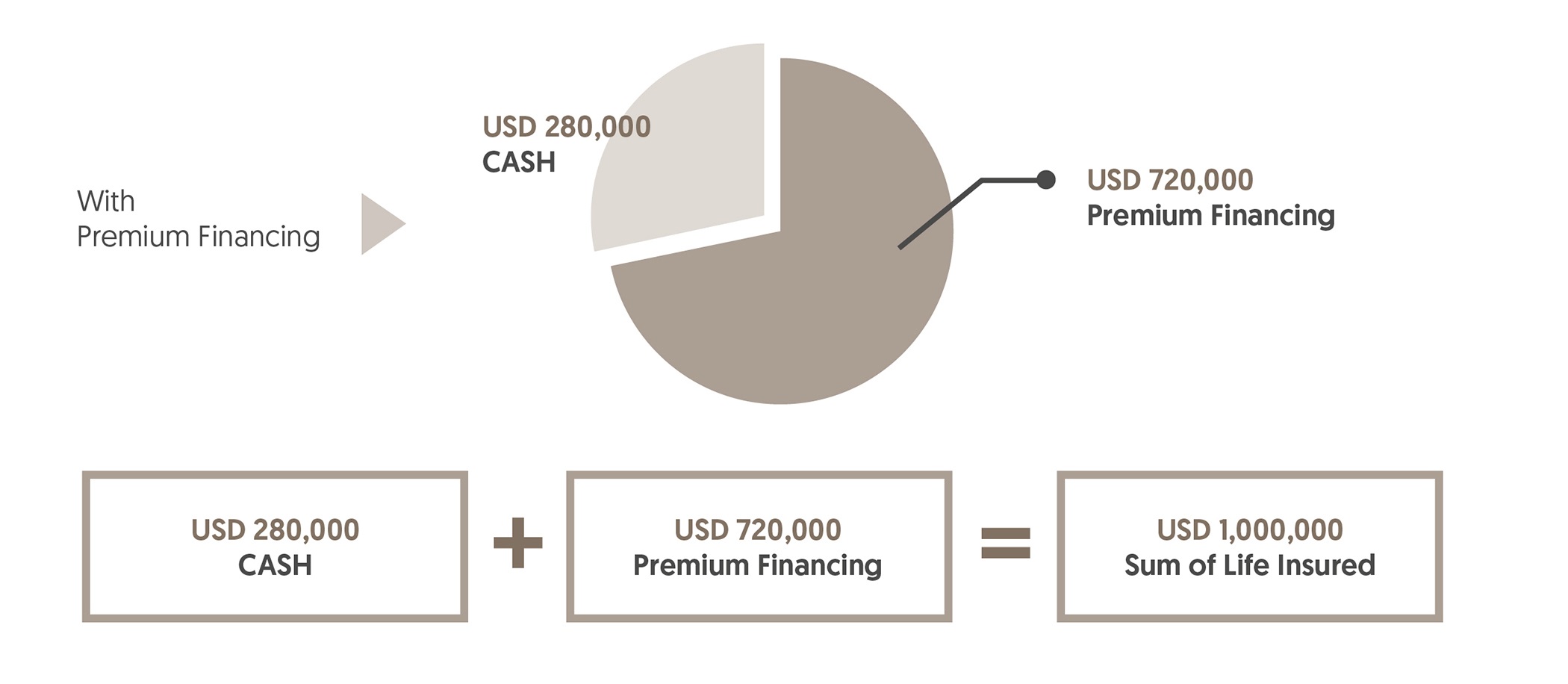

Now Mr. Chan opts to:

- Make a payment of approximately USD 280,000 (not the Single Premium of USD 1,000,000)

- Secure premium financing for the remaining balance of approximately USD 720,000, (Guarantee cash value of policy: USD 800,000, Loan-to-Value ratio : 90%)

- Allowing him to secure the same protection with less upfront cash paid.

Note : Premium Financing is subject to customer insurance needs, details of customers' circumstances, affordability assessment, any other appropriate suitability assessment(s) and credit approval.

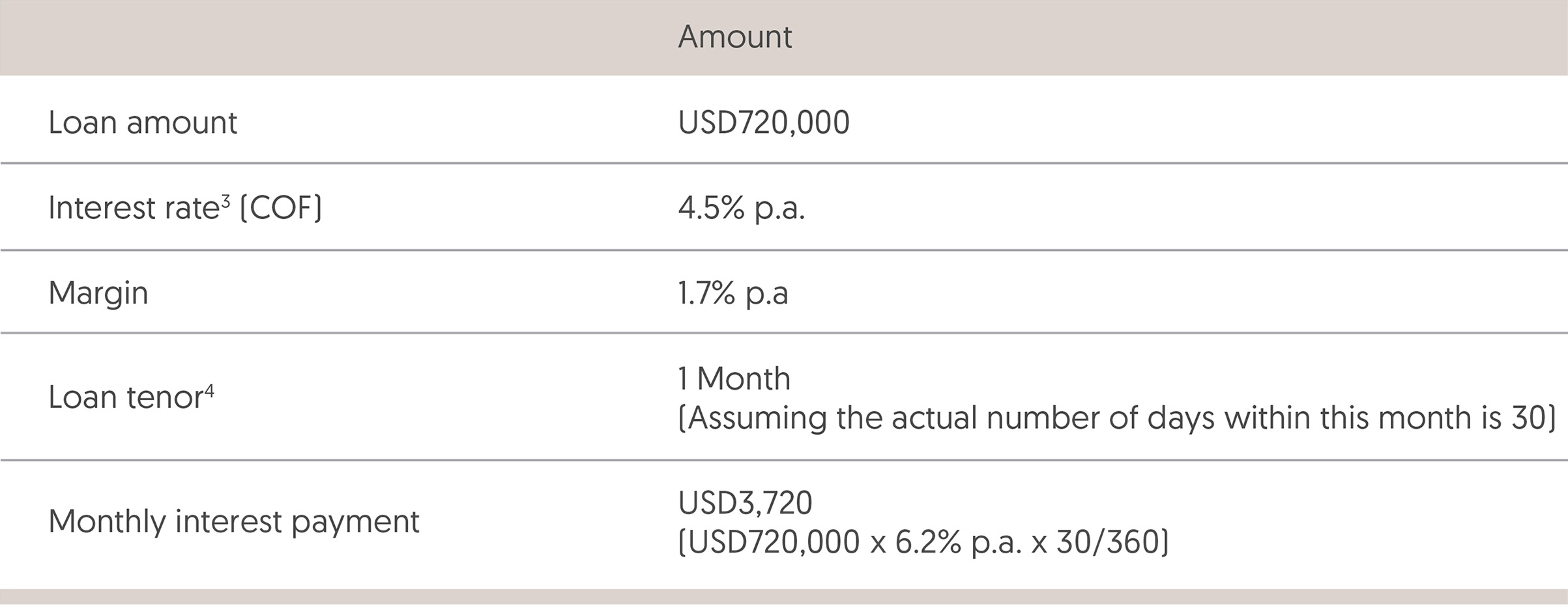

Illustrative example on Premium Financing interest payment

3 COF is subject to re-fixing every loan tenor period, while the margin is fixed. This example charges COF plus a margin of 1.7% p.a. (assuming COF for this month is 4.5% p.a. and the margin is 1.7% p.a.).

4 Maturity of each interest period

Policy return is not guaranteed

Depending on your policy, the market and other factors, dividend payments may not be guaranteed. The non-guaranteed benefits could be zero, which can affect your returns. Unlike certain investment types, there is no historical support for deriving profit from the difference between a loan rate and the return from a life insurance policy.

Assignment of insurance policy

Upon assignment of your insurance policy to the Bank, the Bank reserves its rights to cancel the policy and receive any refund of premium within the cooling-off period, as well as to exercise any options contained in the policy. This may include, but not limited to, obtaining loans or advances on the insurance policy either from the insurance company or from any other parties as permitted by the insurance company, and to pledge or assign the insurance policy as security for such loans or advances. You will not be able to exercise the rights under your insurance policy unless the Bank’s approval is obtained.

Please contact your RM or visit the nearest branches for more details.

Risk Disclosure

Interest Rate Risk

The interest rate applicable to the loan is based on HIBOR, the Bank’s COF or the Bank’s Prime Lending Rate for the specified periods.

- HIBOR: The Hong Kong Interbank Offered Rate for Hong Kong Dollars, rounded to the nearest two decimal places, as published by The Hong Kong Association of Banks.

- COF: The interest rate set by the Bank at its discretion as the Bank’s cost of funds for a specific currency and product.

- Prime Lending Rate: The rate announced by the Bank for lending in Hong Kong dollars or other currencies as stated in the banking facility letter.

Increase in HIBOR or COF or Prime Lending Rate or increase in the applicable interest rate could increase interest payment of the loan, and therefore reduce the overall rate of return of the insurance policy under insurance premium financing arrangement. The financing interest rate may be higher than the returns received from the life insurance policy and customer may be subject to and must be prepared to have significant financial loss. The customer should take into account of this factor when considering whether the insurance premium financing arrangement is suitable for the customer or not. The customer should make sure that he/she can afford to repay the loan and the applicable interest expenses, fees and charges.

If the outstanding loan amount is higher than the credit limit or banking facilities granted to the customer by the Bank (as stated in the facility letter), the loan may be charged at the default interest rate (if applicable). The default interest rate may be substantially higher than the interest rate charged on the loan amount within the credit limit or banking facilities. The customer i.e. the borrower may also be asked to provide additional cash to lower the outstanding loan amount to a level within the credit limit or banking facilities.

Exchange Rate Risk

Exchange rate may go up or down, impacting your returns. There is a possibility that no returns may be payable at all. Exchange rate exposure arises when you, the borrower, choose a loan currency different from the policy currency.

Rate of Return Risk and No Guarantee of Profit

There is a significant risk of loss associated with banking facilities, including Premium Financing related to an insurance policy. You must be prepared for potential losses rather than profits as a result of entering into banking facilities. You should also carefully assess whether this financing arrangement suits your financial situation, including your needs and objectives, target timeframes, desired protection periods, and saving requirements.

Top Up Risk

If the loan-to-value ratio is not met, you shall provide additional collateral or pay a specified cash amount within the time as specified in the relevant letter, upon our request. This is necessary to reduce the outstanding loan amount to below the percentage of the insurance policy’s surrender value mentioned in the facility letter, without affecting our other rights thereunder.

Loan Call Risk

The loan is subject to the Bank’s overriding right to review or modify its terms, or to request immediate repayment of the outstanding loan amount, including the applicable fees, interest, and charges at any time and at the Bank’s sole discretion.

Surrender Risk and Death Benefit Risk

In the event of the surrender of insurance policy before the end of the policy term or death of the life insured during the policy term, the amount received by you or the beneficiary may be less than the total premiums paid and the interest expenses incurred under the facility.

Credit Risk of Insurance Company

The maximum loan-to-value ratio may depend on the credit rating of the insurance company. In the event that the insurance company becomes insolvent or defaults on its obligations, the Bank may seek repayment from you if the amounts received under the policy are insufficient to cover the outstanding loan amount.

In such cases, the Bank may at its discretion call for additional collateral, restructure or terminate the facility, and may require immediate repayment of the outstanding loan amount, fees, interest, and charges if there are concerns about the insurer’s financial stability or creditworthiness.

Reminder: To borrow or not to borrow? Borrow only if you can repay!