Unit Trust

Unit Trust is a collective investment scheme where resources from individual investors are pooled together and managed by professional fund managers. The fund will be invested in worldwide markets through investment instruments such as equities, bonds, currencies, and derivatives.

Benefits

OCBC Bank Unit Trust Services

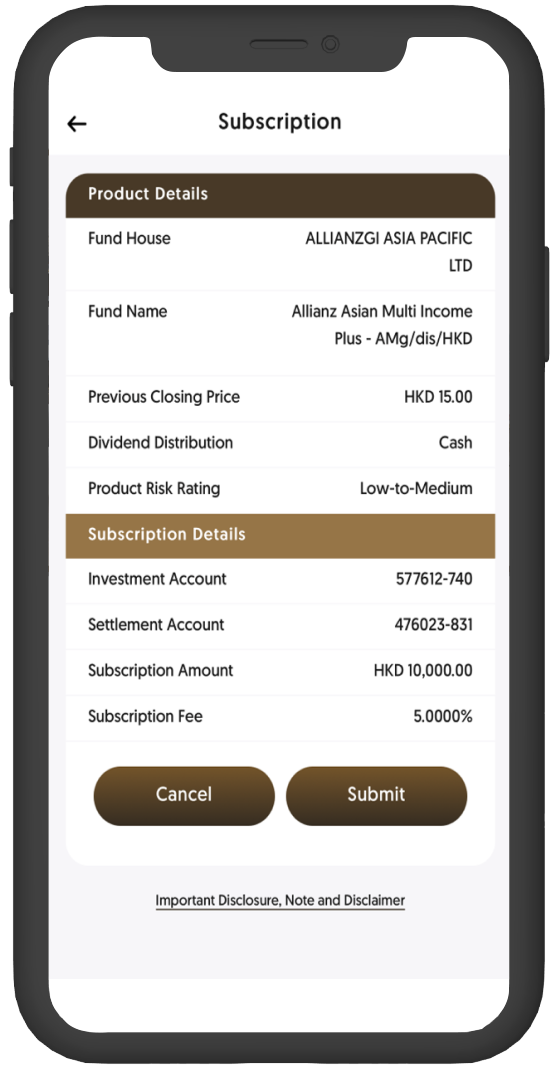

Selected Unit Trusts (List of Unit Trust) that are managed by renowned international asset management companies to meet your different life stages and personal investment needs.

You may invest in Unit Trust in different ways:

- Lump Sum Investment

- Monthly Investment (Unit Trust Monthly Investment Plan)

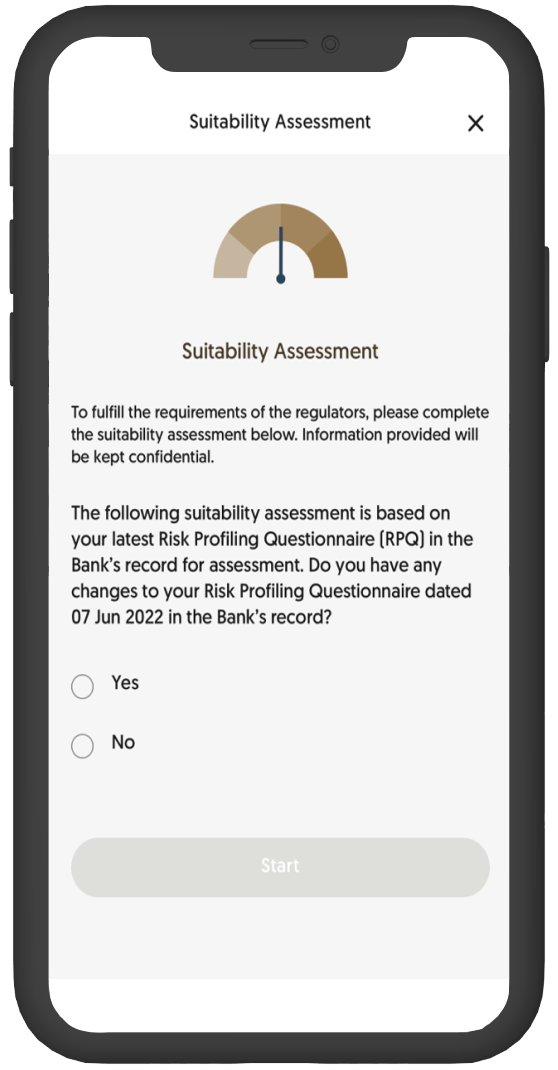

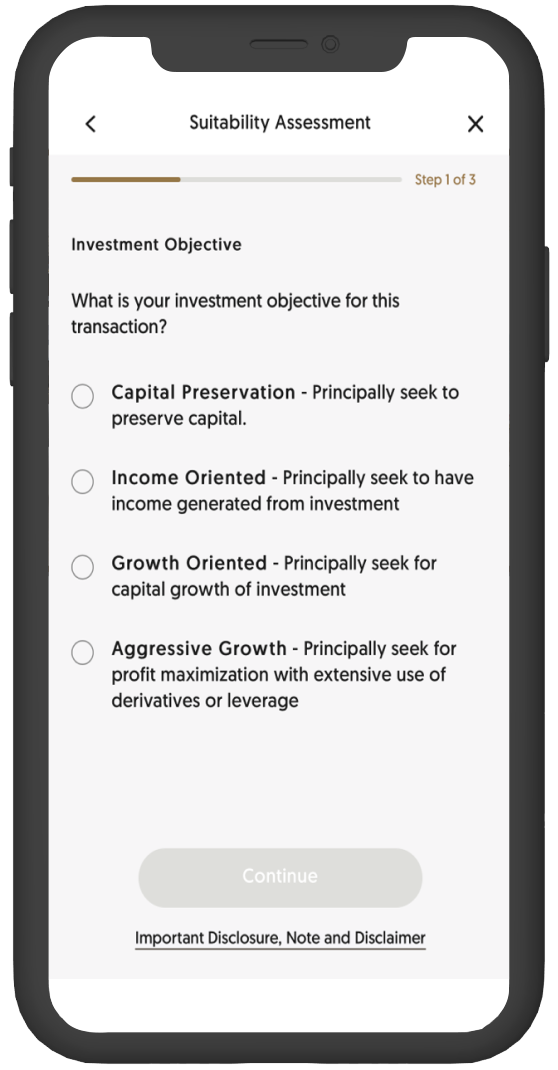

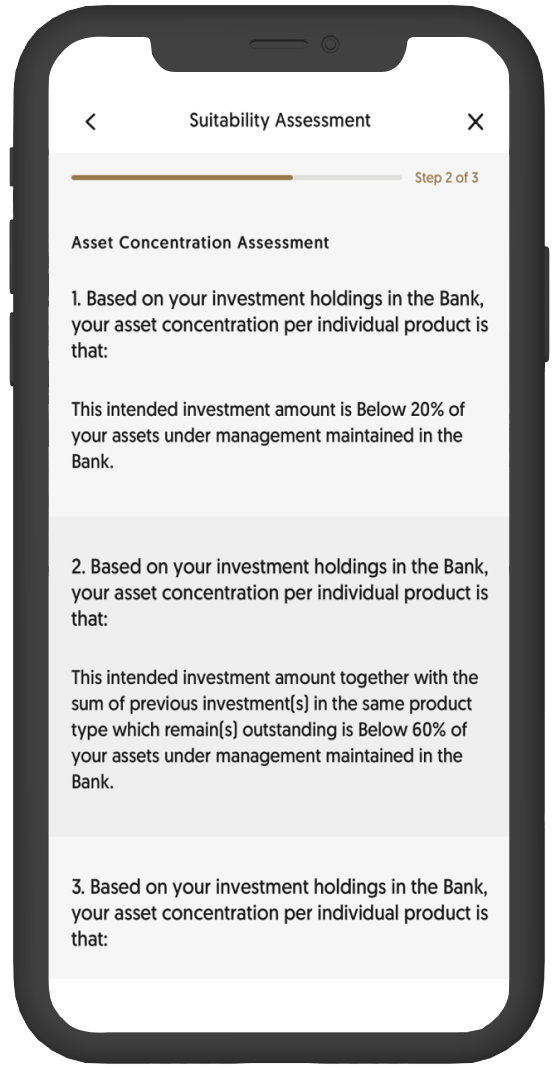

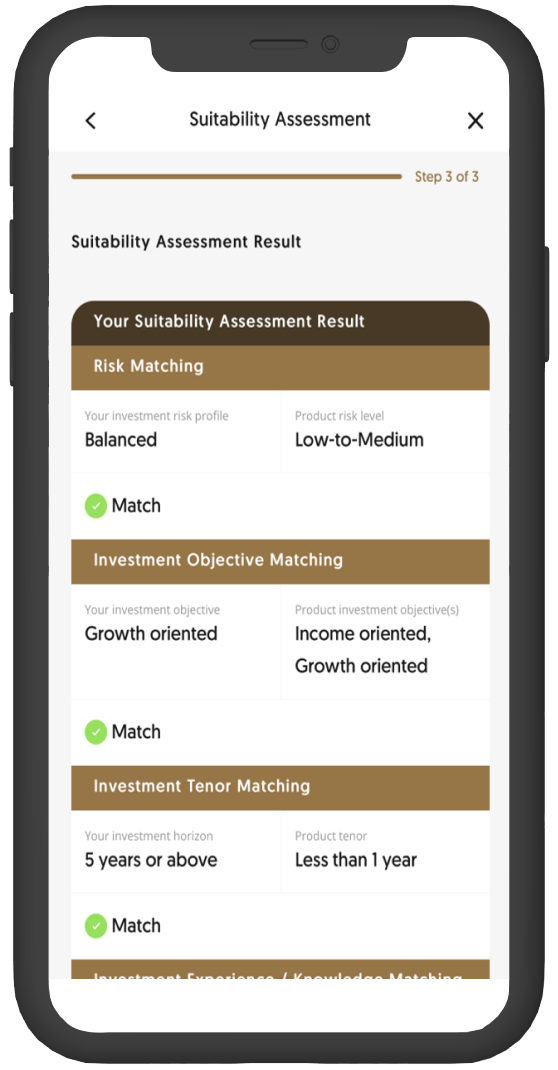

Risk profile assessment is provided to you for your better understanding of your general attitude towards investment risks. Taking into account your risk profile, financial situation, expected investment horizon, investment objective and experience, you could consider a range of investment products which may be suitable for you.

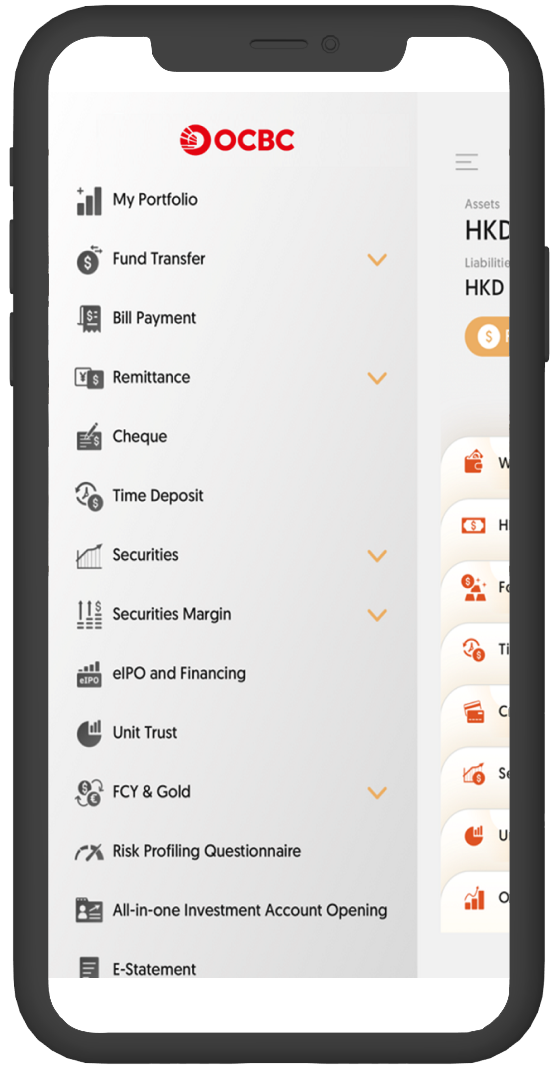

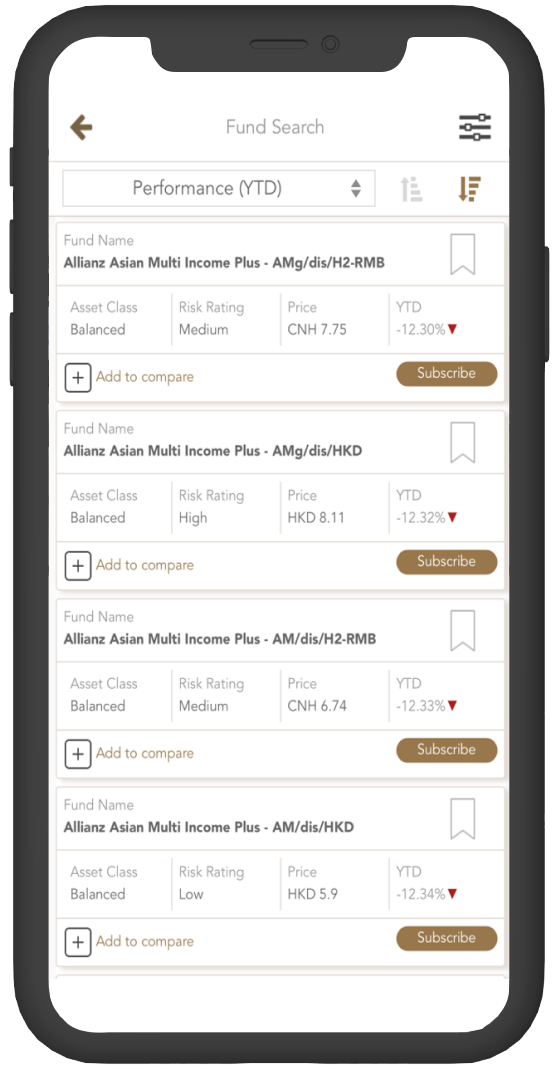

Manage your Unit Trust portfolio and update your Risk Profiling Questionnaire online anytime and anywhere

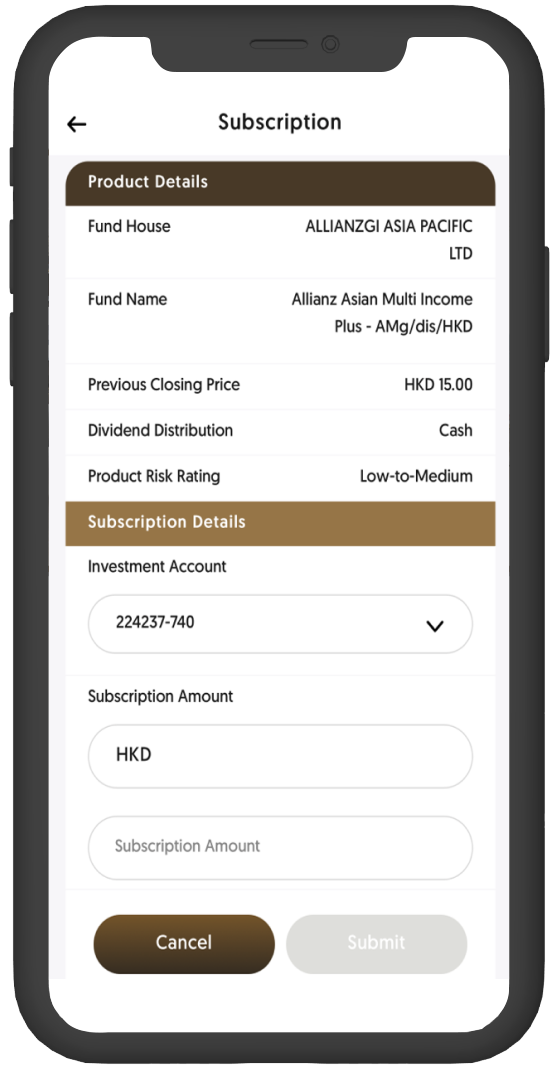

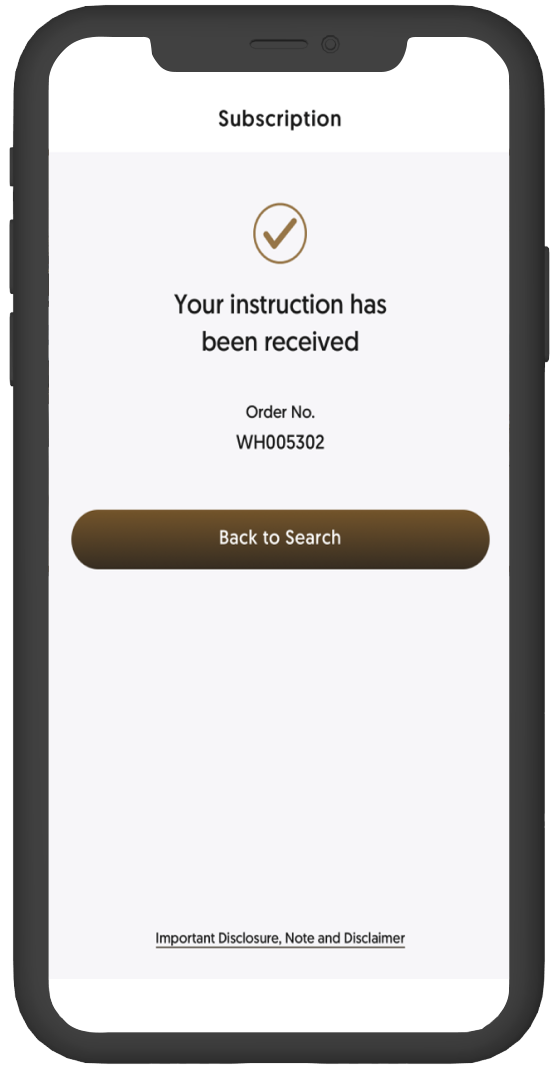

![]() Buy, sell and switch investment funds at your fingertips

Buy, sell and switch investment funds at your fingertips

![]() Set your own watchlist to monitor and manage your investment fund portfolio at ease

Set your own watchlist to monitor and manage your investment fund portfolio at ease

![]() Daily update the best performing funds and fund categories to help you discover investment opportunities*

Daily update the best performing funds and fund categories to help you discover investment opportunities*

![]() Complete the questionnaire to understand your risk appetite

Complete the questionnaire to understand your risk appetite

![]() Renew your questionnaire to ensure that your information is accurate

Renew your questionnaire to ensure that your information is accurate

Lump Sum Investment

If your investment target is HK$1,000,000 in total in 10 years, how much is the investment amount required?

| Years of investment |

Annual rate of return1 5% |

10% | 15% |

|---|---|---|---|

| 5 | $783,526 | $620,921 | $497,177 |

| 10 | $613,913 | $385,543^ | $247,185 |

| 15 | $481,017 | $239,392 | $122,894 |

| 20 | $376,889 | $148,644 | $61,100 |

^ If your investment target is HK$1,000,000 in 10 years' time with 10% annual rate of return continuously, now you have to invest a lump-sum of approximately HK$385,543!

The above figures are for illustrative purpose only and the actual performance of the product may differ from the figures shown. The Bank is not making any prediction on future return of the product based on the any past performance. Fluctuations in the price of invested product may result in significant losses or even become worthless.

Ways to Apply

Remarks

- The above tables are for hypothesis illustration only and are not intended to be representative of the performance of any particular investment. The hypothetical annual rate of return is not indicative of the actual return likely to be achieved by investing in any fund. These tables exclude inflation rate and any other fees incurred in fund subscription.

Investment involves risks and the price of investment products may fluctuate or even become worthless. Past record is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. Investment funds which invest in certain markets (e.g. Emerging Market) may involve a higher degree of investment risks.

Certain investment funds may use financial derivative instruments to meet their investment objectives (please refer to respective offering document for detailed information), thus entailing higher volatility in net asset value. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile.

The respective fund management company is the only person quoting prices and counterparty for the fund(s) under its management. You should therefore carefully consider the liquidity risk involved. Independent professional advice should be obtained if necessary. Please carefully read the relevant offering document (including but not limited to the risk factors stated therein) and terms and conditions before making any investment decisions.

The above mentioned investment products are neither protected by the Deposit Protection Scheme nor the Investor Compensation Fund in Hong Kong.

Please note that the unit price shown for each fund is based on its latest fund's NAV or its Bid price and is for reference only. The actual subscription price of each fund may be different to the reference offer price. All prices are subject to final confirmation by the Bank. Unit price information of each fund is shown in its denominated currency or reporting currency. Investment returns are denominated in the respective fund’s base currency (may be a foreign currency). You may be exposed to the risks of fluctuations in the exchange rate of USD / HKD / foreign currency.

The above mentioned investment fund(s) has been authorized by the Securities and Futures Commission in Hong Kong (the "SFC"). However, SFC authorization is not a recommendation or endorsement of an investment fund nor does it guarantee the commercial merits of an investment fund or its performance. It does not mean the investment fund is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

The information on this webpage has not been reviewed by the SFC.