This scenario analysis for Currency Linked Target Rate Deposit is based on the following terms (CNY Bullish view):

| Deposit Currency |

CNY |

| Principal Amount |

CNY 100,000.00 |

| Deposit Tenor |

6 Months (180 days) |

| Currency Pair |

USD/CNY |

| Initial Fixing Rate |

6.1000 (USD/CNH) |

| Strike Rate (A): |

6.0390 (USD/CNH) |

| Strike Rate (B): |

6.2000 (USD/CNH) |

| Fixing Rate: |

The exchange rate of the Currency Pair on the Exchange Rate Fixing Date |

Interest Rate:

(1) Target Return Rate (A)

OR

(2) Target Return Rate (B)

OR

(3) Minimum / Lower Return Rate

(it may be zero)

|

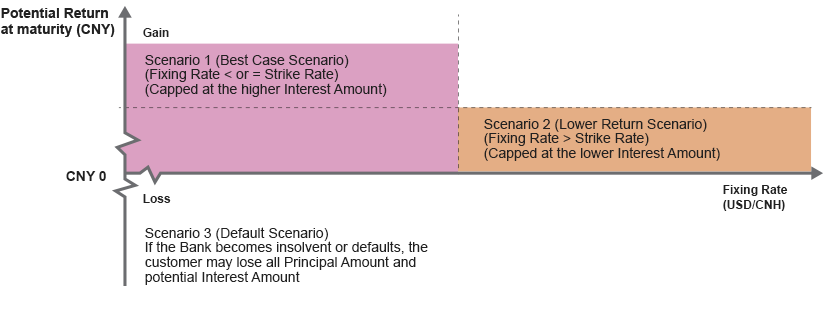

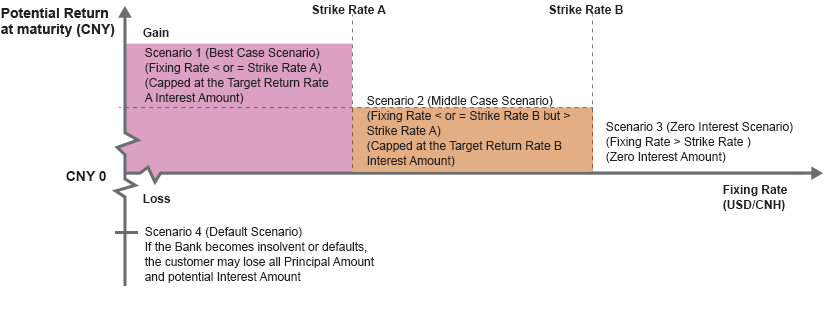

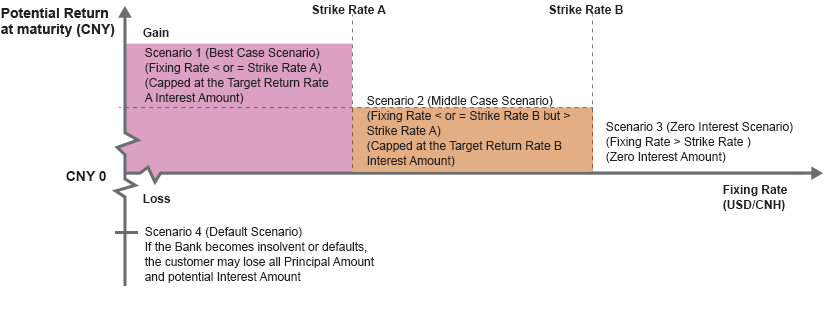

If the Fixing Rate on the Exchange Rate Fixing Date is:

(1) at or below of the Strike Rate (A), 8.00% p.a. will be applied;

OR

(2) at or below of the Strike Rate (B) but above Strike Rate (A), 3.00% p.a. will be applied; OR otherwise

(3) 0.00% p.a. will be applied

|

Scenario 1 (Best Case Scenario) – the Fixing Rate is AT or BELOW the Strike Rate (A)

Assuming the Fixing Rate is AT or BELOW the Strike Rate (A) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Target Return Rate (A) as follows:

= Principal Amount + Interest Amount calculated at the Target Return Rate (A)

= CNY 100,000.00 + CNY 4,000.00

= CNY 104,000.00

Interest Amount

= CNY 100,000.00 × 8.00% ÷ 360 × 180

= CNY 4,000.00

In this scenario, you have an actual gain of an Interest Amount of CNY 4,000.00, representing an actual rate of return of 4.00% (i.e. Interest Amount (CNY 4,000.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places). This is the maximum potential gain under Currency Linked Target Rate Deposit even if your view on the Fixing Rate is correct.

Scenario 2 (Middle Case Scenario) – the Fixing Rate is AT or BELOW the Strike Rate (B) but ABOVE Strike Rate (A)

Assuming the Fixing Rate is AT or BELOW the Strike Rate (B) but ABOVE Strike Rate (A) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Target Return Rate (B) as follows:

= Principal Amount + Interest Amount calculated at the Target Return Rate (B)

= CNY 100,000.00 + CNY 1,500.00

= CNY 101,500.00

Interest Amount

= CNY 100,000.00 × 3.00% ÷ 360 × 180

= CNY 1,500.00

In this scenario, you have an actual gain of an Interest Amount of CNY 1,500.00, representing an actual rate of return of 1.50% (i.e. Interest Amount (CNY 1,500.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places). This is the potential gain under Currency Linked Target Rate Deposit even if your view on the Fixing Rate is correct.

Scenario 3 (Zero Return Scenario) – the Fixing Rate is ABOVE the Strike Rate (B)

Assuming the Fixing Rate is ABOVE the Strike Rate (B) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Minimum / Lower Return Rate (i.e. zero) as follows:

= Principal Amount + Interest Amount calculated at the minimum / lower Interest Rate

= CNY 100,000.00 + CNY 0.00

= CNY 100,000.00

Interest Amount

= CNY 100,000.00 × 0.00% ÷ 360 × 180

= CNY 0.00

In this scenario, you can only get back the Principal Amount.

Scenario 4 (Default Scenario) – The Bank defaults in payment or becomes insolvent

Assuming that the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank regardless of the terms of this product. You may get nothing back and may lose all of your Principal Amount of CNY 100,000.00 and the potential Interest Amount even if your view on the movement of exchange rates is correct.

Scenario Summary and Potential Return Analysis

| Scenario |

Fixing Rate

(USD/CNH) |

Total payout on the maturity date |

Investment return at maturity (CNY) |

Gain or loss against the Principal Amount (Actual %) |

| 1 |

6.0300 |

CNY 104,000.00 |

CNY 4,000.00 |

4.00% |

| 2 |

6.0600 |

CNY 101,500.00 |

CNY 1,500.00 |

1.50% |

| 3 |

6.2100 |

CNY 100,000.00 |

CNY 0.00 |

0.00% |

| 4 |

You will be ranked as an unsecured creditor against the Bank if the Bank becomes insolvent or defaults on its obligations under this product and you may lose the entire Principal Amount of CNY 100,000.00 and the potential Interest Amount. |

CNY Bullish Example (Multiple Strike Rate)

Scenario 5 – if your home currency is not CNY

This scenario is based on the assumption that you convert USD16,393.44 (Principal Amount in Home Currency) to CNY100,000 at the Exchange Rate of 6.1000 (USD/CNH) and invest the Principal Amount CNY100,000 in this product.

Gain Scenario

Assuming that the Fixing Rate is AT or BELOW the Strike Rate (A) on the Fixing Date, as elaborated under scenario 1 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY4,000.00 = CNY104,000.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will make a gain only if the prevailing exchange rate is below 6.3440 (USD/CNH). Assuming that the prevailing exchange rate between USD and CNY is 6.0390 (USD/CNH), you will receive USD17,221.39 (CNY104,000.00 / 6.0390). In this example, you will have an actual gain of USD827.95 (USD17,221.39 - USD16,393.44) or 5.05% (USD827.95 / USD16,393.44).

Break Even Scenario

Assuming that the Fixing Rate is AT or BELOW Strike Rate (B) but ABOVE Strike Rate(A), as elaborated in scenario 2 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY1,500.00 = CNY101,500.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY.

Assuming that the prevailing exchange rate between USD and CNY is 6.1915 (USD/CNH), you will receive USD16,393.44 (CNY101,500.00 / 6.1915) which is equal to your initial investment amount in your home currency.

Losing Scenario

Assuming that the Fixing Rate is ABOVE Strike Rate (B), as elaborated in scenario 3 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY0.00 = CNY100,000.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will suffer a loss once the prevailing exchange rate is above 6.1000 (USD/CNH).

Assuming that the prevailing exchange rate between USD and CNY is 6.2100 (USD/CNH), you will receive USD16,103.06 (CNY100,000.00 / 6.2100). In this example, you will have an actual loss of USD290.38 (USD16,103.06 – USD16,393.44) or 1.77% (USD290.38 / USD16,393.44).

In the worst case whereby CNY depreciates to zero, you may lose all of your investment.