Currency-linked Deposit

It is a structured investment product that combines a time deposit and a foreign currency option for you to capture additional potential return on your investment from FX market.

How to apply

It is a structured investment product that combines a time deposit and a foreign currency option for you to capture additional potential return on your investment from FX market.

How to apply

Enjoy additional potential interest higher than a normal time deposit

Opportunity to convert the currency you needed at agreed exchange rate on maturity date, for studying abroad, doing business or travelling, etc.

Available Tenor ranging from 7 days to 6 months.

Currencies for your choice include HKD, USD, AUD, CAD, NZD, CNY, JPY, CHF, GBP and EUR with 88 currency pairs.

Minimum deposit amount to as low as HKD100,000 or its equivalent

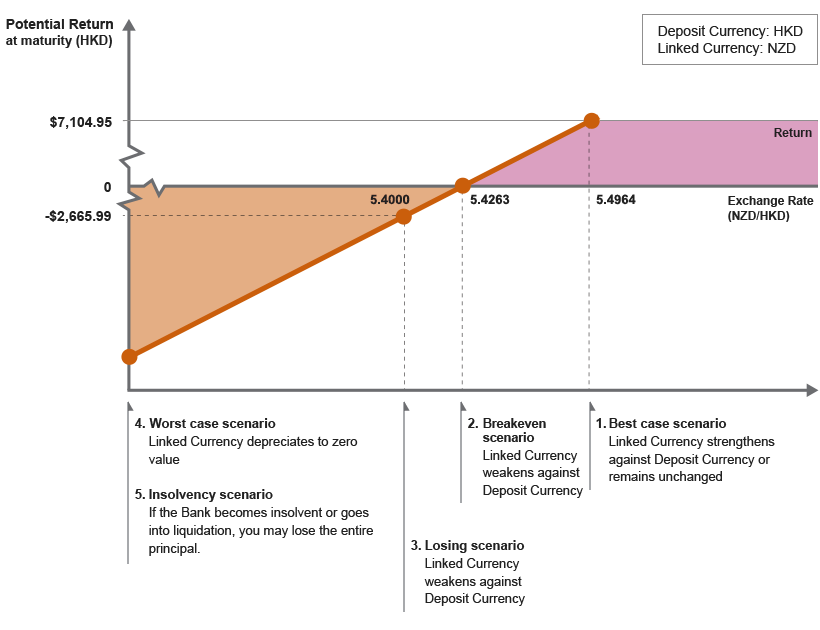

| Currency-linked Deposit | |

|---|---|

| Deposit Currency | HKD |

| Principal Amount | $550,000 |

| Linked Currency | NZD |

| Tenor | 31 days |

| Value Date | March 18, 20XX |

| Strike Rate* | 5.4964 (i.e.NZD1 = HKD5.4964) |

| Exchange Rate Fixing Date / Maturity Date | April 18, 20XX |

| Interest Rate (p.a.)^ | 15.21% |

| Value at Maturity Date@ | If the Fixing Rate is at or above the Strike Rate (i.e.5.4964), HKD 557,104.95 in total will be paid. (Calculation: $550,000x15.21%x31/365+$550,000) If the Fixing Rate is below the Strike Rate (i.e.5.4964), NZD 101,358.15 in total will be paid. (Calculation: ($550,000x15.21%x31/365+$550,000) /5.4964) |

* Spot exchange rate is 5.5159 (i.e. NZD1=HKD5.5159)

^ This is expressed in an annualised format and is based on the hypothetical assumption that the CLD (HKD as “Deposit Currency”) can be rolled over on the same terms for a period of 365 days. It does not reflect the actual Rate of Return of the CLD for the Deposit Tenor. You should not rely on the Interest Rate in an annualized format as an indication of the expected return for the CLD.

@ All calculation results are rounded to two decimal places.

| Fixing Rate@ | Value at Maturity Date@ | Net gain or loss@ | Rate of Return (Actual%)@ |

|

|---|---|---|---|---|

| 1. Best case scenario – Linked Currency strengthens against Deposit Currency or remains unchanged | ||||

| NZD strengthens against HKD or remains unchanged | 5.4964 or above | HKD 557,104.95 | HKD 7,104.95 | +1.29% |

| 2. Breakeven scenario – Linked Currency weakens against Deposit Currency | ||||

| NZD weakens against HKD | 5.4263 (exchange rate down by 1.6244%) |

NZD 101,358.15 (equivalent to HKD 549,999.73#) |

(HKD 0.27) | approximately 0.00% |

| 3. Losing scenario – Linked Currency weakens against Deposit Currency | ||||

| NZD weakens against HKD | 5.4000 (exchange rate down by 2.1012%) |

NZD 101,358.15 (equivalent to HKD 547,334.01#) |

(HKD 2,665.99) | -0.48% |

| 4. Worst case scenario – Linked Currency depreciates to zero | ||||

| NZD depreciates to zero | 0.0000 (exchange rate down to zero) |

NZD 101,358.15 (equivalent to HKD 0.00#) |

(HKD 550,000.00) | Loss of entire Principal Amount |

| 5. Insolvency scenario – The Bank defaults | ||||

| If the Bank becomes insolvent or goes into liquidation, you may lose the entire Principal Amount. | ||||

# Equivalent amount in HKD = NZD (P+I) x Fixing Rate

@ All calculation results are rounded to two decimal places except for the decreases in percentages of the exchange rates, which are rounded to four decimal places.

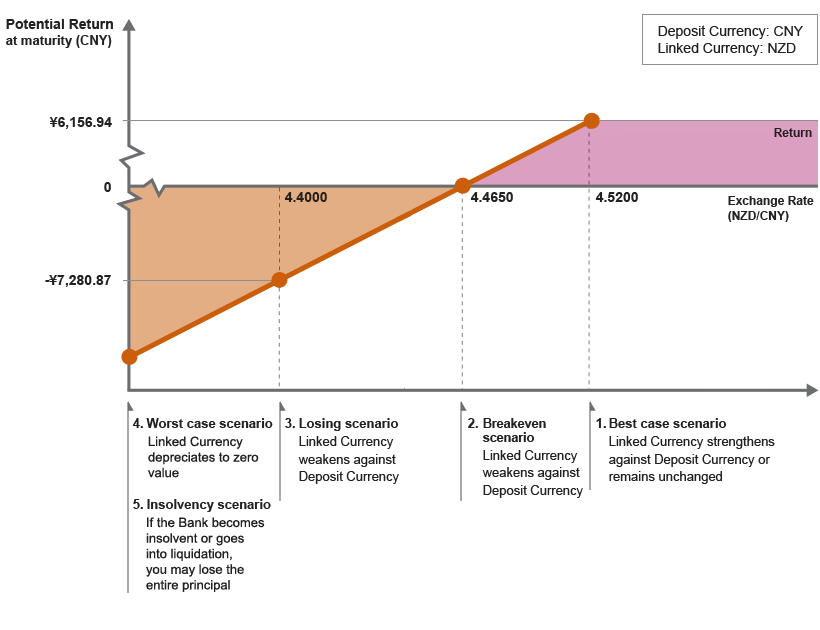

| Currency-linked Deposit | |

|---|---|

| Deposit Currency | CNY |

| Principal Amount | ¥500,000 |

| Linked Currency | NZD |

| Tenor | 31 days |

| Value Date | March 18, 20XX |

| Strike Rate* | 4.5200(i.e.NZD1 = CNY4.5200) |

| Exchange Rate Fixing Date / Maturity Date | April 18, 20XX |

| Interest Rate (p.a.)^ | 14.30% |

| Value at Maturity Date@ | If the Fixing Rate is at or above the Strike Rate (i.e.4.5200), CNY 506,156.94 in total will be paid. (Calculation: ¥500,000 x 14.30% x 31/360 + ¥500,000) If the Fixing Rate is below the Strike Rate (i.e.4.5200), NZD 111,981.62 in total will be paid. (Calculation: (¥500,000 x 14.30% x 31/360 + ¥500,000) /4.5200) |

* Spot exchange rate is 4.5375 (i.e. NZD1=CNY4.5375)

^ This is expressed in an annualised format and is based on the hypothetical assumption that the CLD (CNY as “Deposit Currency”) can be rolled over on the same terms for a period of 360 days. It does not reflect the actual Rate of Return of the CLD for the Deposit Tenor. You should not rely on the Interest Rate in an annualized format as an indication of the expected return for the CLD.

@ All calculation results are rounded to two decimal places.

| Fixing Rate@ | Value at Maturity Date@ | Net gain or loss@ | Rate of Return (Actual%)@ |

|

|---|---|---|---|---|

| 1. Best case scenario – Linked Currency strengthens against Deposit Currency or remains unchanged | ||||

| NZD strengthens against CNY or remains unchanged | 4.5200 or above | CNY 506,156.94 | CNY 6,156.94 | 1.23% |

| 2. Breakeven scenario – Linked Currency weakens against Deposit Currency | ||||

| NZD weakens against ZCNY | 4.4650 (exchange rate down by 1.5978%) |

NZD 111,981.62 (equivalent to CNY 499,997.93#) |

(CNY 2.07) | approximately 0.00% |

| 3. Losing scenario – Linked Currency weakens against Deposit Currency | ||||

| NZD weakens against CNY | 4.4000 (exchange rate down by 3.0303%) |

NZD 111,981.62 (equivalent to CNY 492,719.13#) |

(CNY 7,280.87) | -1.46% |

| 4. Worst case scenario – Linked Currency depreciates to zero | ||||

| NZD depreciates to zero | 0.0000 (exchange rate down to zero) |

NZD 111,981.62 (equivalent to CNY 0.00#) |

(CNY 500,000.00) | Loss of entire Principal Amount |

| 5. Insolvency scenario – The Bank defaults | ||||

| If the Bank becomes insolvent or goes into liquidation, you may lose the entire Principal Amount. | ||||

# Equivalent amount in CNY = NZD (P+I) x Fixing Rate

@ All calculation results are rounded to two decimal places except for the decreases in percentages of the exchange rates, which are rounded to four decimal places.

Taking the Best case scenario (case 1) in Example 2 above where the value at maturity date is CNY 506,156.94, assuming that HKD is your home currency and you choose to convert the value (at maturity date) back to your home currency at maturity, the following table shows your rate of gain/ loss against the Principal Amount in HKD, taking into account the fluctuation in the exchange rate of CNY (being the Deposit Currency) against HKD (being your home currency):

| Exchange rate of CNY/HKD on trade date (express as the amount of HKD per one CNY) | Principal amount on trade date (HKD Equivalent) | Exchange rate of CNY/HKD on maturity date (express as the amount of HKD per one CNY) | Value on maturity date (HKD Equivalent)@ | Rate of Return (Actual%)@ |

|---|---|---|---|---|

| 1. CNY appreciates against HKD | ||||

| 1.10 | HKD 550,000 | 1.15 | HKD 582,080.48 | + 5.83% |

| 2. CNY depreciates against HKD | ||||

| 1.10 | HKD 550,000 | 1.05 | HKD 531,464.79 | -3.37% |

| 3. CNY depreciates significantly against HKD | ||||

| 1.10 | HKD 550,000 | 0.00 | HKD 0 | -100% |

@ All calculation results are rounded to two decimal places.

The illustrative examples above are hypothetical and provided for illustration purpose only. The above scenarios are not based on the past performance of the Linked Currency against Deposit Currency and do not represent all possible outcomes or describe all possible factors that may affect the return for investing in our CLD. The Bank is not making any prediction on future movements of the exchange rates between Linked Currency and Deposit Currency by virtue of providing the illustrative examples. The scenarios assume no fees and charges.