Internet, Mobile & Telemetic Banking

Account Service

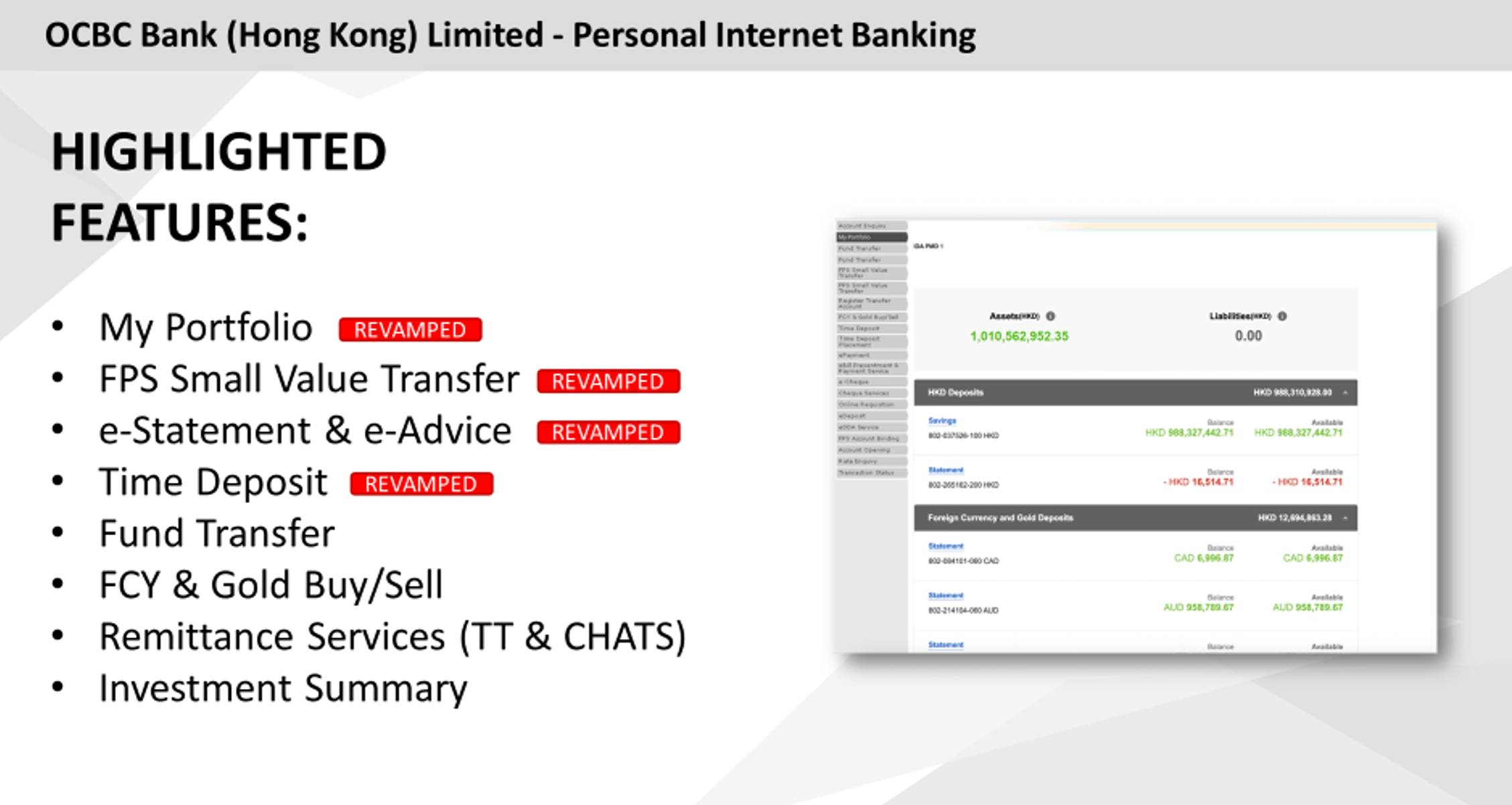

- Account Balances and Transaction History Enquiry

- eStatement and eAdvice Service

- HKD and Foreign Currency ("FCY") Fund Transfer

- Time Deposit Placement / Enquiry / Renewal / Withdrawal and Change of Maturity Instruction

- ePayment - Paying over 600 merchants and utilities bills1,2,3

- Electronic Bill Presentment and Payment Service - View eBill summary issued by merchants and make payment or donation1,2,3,4

- Card payment

- eDeposit - Real-time fund transfer from other local bank account to the Bank's HKD or credit card account

- Deposit Rates, FCY Exchange Rates and Gold Prices Enquiry

- Cheque Status Enquiry, Stop Cheque Payment and Cheque Book Requisition

- Account Opening (Including investment account, statement savings account and time deposit account)

Investment

- Investment Portfolio Enquiry

- FCY and Gold Trading

- Pre-set FCY and Gold Buy / Sell Order

- Securities Trading (with free SMS order confirmation service)

- eIPO and Financing

- Unit Trust Subscription, Switching and Redemption

- Stock and Unit Trust Monthly Investment Plan

- Currency-linked and Equity Linked Deposit

Remittance

- Telegraphic Transfer

- CHATS

- HK-Macau Instant Remittance

Other Services

- Overseas ATM Cash Withdrawal Setting

- Banking Service and Daily Limit Maintenance

- Update Account List

- Change of Personal Information

- Change of Security Mode for Online Securities Trading

Security Device

With the OCBC Bank "Security Device", you can generate a One-Time Security Code as a second verification when performing the below designated online transactions and instructions on our Internet Banking. With the use of "Security Device", you can enjoy a higher degree of protection and security for your online transactions

- Fund Transfer to Non-Registered Third Party Account (includes OCBC Bank and Other Bank Account Transfer, Telegraphic Transfer, CHATS and HK-Macau Instant Remittance)

- Register Transfer Account

- Payment/Donation to Non-Registered Merchant Bills

- Change Setting for Overseas ATM cash withdrawal

- Change Setting for Daily Transaction Limits Online

How to get started

- Maintain a valid eBanking account

- Keep valid mobile phone number in bank record

- Apply to the Bank for the Security Device*

- Activate the Security Device upon receipt

- Set up daily transaction limit (if needed)

- Use the Security Device to generate a One-Time Security Code when performing designated online transactions or instructions

Relish hundred percent security protection

We have adopted a universal encryption standard, 128-bit Secure Sockets Layer (SSL), for Internet message transmission and Triple Data Encryption Standard (3DES) for electronic banking services. Two-factor authentication further protects you from fraud and increases the security when you conduct designated transactions via Internet Banking. Our Personal eBanking provides you with the most confidentiality and keeps your personal information out of reach from others.

For more security information about Internet Banking/Mobile Banking and Telematic Banking, please refer to our Security Tips.