OCBC Premier VOYAGE Card

OCBC Premier VOYAGE Card

............

Meticulously crafted to be the companion of the discerning traveller, OCBC Premier VOYAGE Card can get you to any city in the world, on any airline with your VOYAGE Miles, any day of the year.

What is VOYAGE Mile?

............

VOYAGE Mile is a unique mile currency you earn with each spend on your OCBC Premier VOYAGE Card.

NO BLACKOUT DATE

Redeem for flights on any airline, anytime, with no blackout date (subject to availability of tickets on desired flight).

EARN UNLIMITED MILES

Earn miles as much as you spend with no cap.

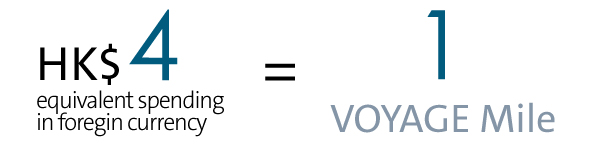

Earn As You Spend

............

As an OCBC Premier VOYAGE cardholder, you will enjoy

STRETCH YOUR VOYAGE MILES FURTHER

............

Besides using your VOYAGE Miles to redeem an air ticket, you can redeem VOYAGE Rebate to reward your travel (including travel agencies, airlines and hotel) and foreign currencies spending

REDEEMING YOUR VOYAGE REBATE

10 VOYAGE MILES → HK$1 VOYAGE REBATE*

OCBC Premier / Bank of Singapore VOYAGE Rebate Redemption Form

*Minimum conversion per request is 1,000 VOYAGE Miles to HK$100 VOYAGE Rebates. Terms and conditions apply, please refer to Terms and Conditions Governing the VOYAGE Credit Card Program.

Service that goes beyond with VOYAGE Exchange

............

Your one-stop personal concierge that assists, plans and organises all your travel and lifestyle needs 24 hours a day, 7 days a week, including the following:

TRAVEL

Plan extraordinary travel itineraries with expert help, book air tickets and secure hotel reservations.

Dining

Receive personalised new dining recommendations and score hard-to-get restaurant reservations anywhere in the world.

events

Get exclusive tickets to concerts, art shows and gallery openings.

SHOPPING

Locate local and overseas luxury items for any occasion, and make inquiries on shopping services.

Privileges

............

| AIRPORT EXPERIENCES |

|

Enjoy 4 complimentary visits to selected airport lounges every calendar year (US$32 per person/visit for all guests), with complimentary refreshments and snacks, and access to business facilities. Please download “Mastercard Travel Pass” mobile app to enjoy the Airport Lounges service. |

| COMPLIMENTARY TRAVEL INSURANCE |

|

Charge your airline tickets to your Premier VOYAGE Card to enjoy up to US$ 1 million in travel protection insurance coverage. |

| LIMOUSINE AIRPORT/TERMINAL TRANSFER SERVICE |

|

Travel with limousine airport/ terminal transfer. Each principal cardholder paying the annual membership fee or

|

| EXCLUSIVE MASTERCARD BENEFITS |

|

Gain exclusive access to a world of golf, travel, shopping and dining experiences including special upgrades, package deals and offers. For the full list of privileges, please click here. |

Application Details

............

|

Eligibility

● 18 years old and above ● Premier Banking customers only |

Annual Membership Fees

Supplementary Card: HK$3,400, first year waived for the first supplementary card Annual membership fees apply and will be charged upon approval of card unless stated otherwise above. |

How to apply

............

To apply for your card, please speak to your Relationship Manager.